- Saylor sees that Bitcoin overtakes gold and real estate, whereby institutional assumption drives its long -term growth.

- He supports a US bitcoin reserve because it keeps inflation small and can strengthen the economy.

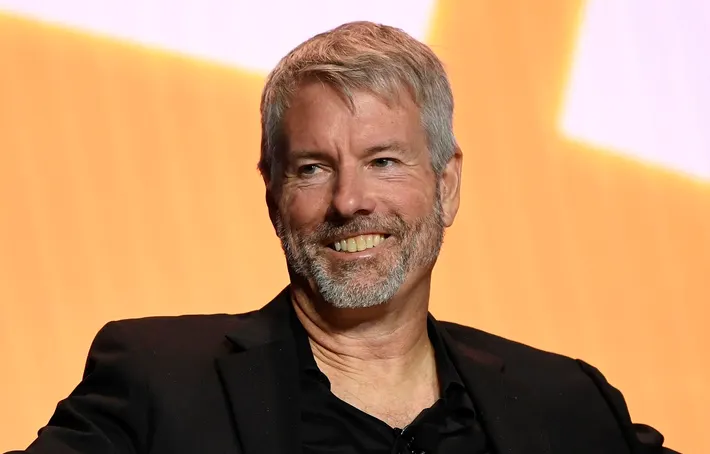

In his outlook, Michael Saylor predicts that Bitcoin will develop into $ 100 trillion and will change the global financial operations. As the CEO of Strategy – formerly Microstrategy – argumentedBitcoin works perfectly as a “capital keeping instrument” because it is a scarce good that the control of central banks is evading.

According to Saylor, Bitcoin will eventually become the infrastructure of the digital financial system and sell gold, real estate and other traditional assets to achieve an assessment of $ 100 trillion. The Bitcoin market will drive itself when institutions and governments introduce it as a currency and its value will continue to increase.

Bitcoin in the global financial world and its takeover by institutions

Saylor persistently supported Bitcoin by emphasizing his ability to use current financial market instruments. During his last speech, Saylor once again promised that BTC would reach a market capitalization of $ 200 trillion by 2045. Saylor cited the supply restrictions, the decentralized structure and protection against inflation pressure as reasons for the market expansion of Bitcoin.

The business strategy of the intensive Bitcoin battery fits this transformation goal. Tokyo Marine Holdings acquired more than half a million BTC by using convertible bonds as financial instruments for the procurement of funds. According to Saylor, the Bitcoin Prize is likely to increase because other companies will take over this approach. According to Saylor, the institutional takeover creates a positive feedback loop that naturally drives the increase in value and attracts more participants to the system.

The acceptance of Bitcoin through the mainstream markets depends heavily on clearly defined regulatory rules. Bitcoin Company supports a policy that enables technological development and protects investors from risks. Saylor advocates tax regulations that enable Bitcoin’s acceptance and at the same time prevent development from declining. According to his statements, market -wide regulations would enable institutions to integrate BTC into their financial strategies and thus promote the expansion of BTC.

Strategic Bitcoin reserve for national security

During his interview, Saylor advocated setting up a strategic bitcoin reserve in the USA as a matter of national security. He suggested that the purchase of Bitcoin would follow the same pattern as the acquisition of gold and oil by the government, and that it would strengthen the economic position of the United States. The strategic positioning of BTC as an asset enables the country to reduce inflation risks and to stabilize its financial systems during the changeover to digital economic operations.

He emphasized that Fiat currencies continue to lose value due to inflation, which makes Bitcoin a necessary protection against economic uncertainties. With its fixed offer and decentralized nature, BTC offers protection against the decreasing purchasing power of traditional money. Saylor believes that governments around the world will finally take over Bitcoin as a pillar of economic resistance.

In his opinion, Bitcoin will be the leading force in digital finance and will combine with artificial intelligence and decentralized financial systems. BTC represents the “perfect money” due to its unchangeable nature, its safe platform and its fixed offer. In his explanations, he recognized the far-reaching possibilities of blockchain technology, but confirmed that Bitcoin maintains a superior status compared to other digital assets.

Saylor believes that the upcoming regulatory improvements will boost institutional use of Bitcoin. BTC’s adoption rate has expanded to the use of payment systems and the infrastructure of the financial system beyond investment use. Bitcoin shows a promising development, since institutions are agreed in larger number and governments are interested, which makes him convince that it will consolidate its status as a fundamental asset.

No Comments