Bitcoin under pressure: What the US Customs Policy means against global free trade for crypto

- Times are more difficult for Bitcoin because the global trade voltages and the M2 money increase increase.

- But ETF drains and a weak dollar do not stop Bitcoin’s long-term growth in the long term-as long as the trust of the institutions is there.

Bitcoin is facing a difficult week because the global trade conflict with the USA and unsafe liquidity makes the markets carefully. In particular, the fully broken trade war between the USA and China is increasingly continuing to make the market mood and dealers are concerned about the rising M2 money.

The Bitcoin course is struggling to overcome important resistance, with the success of external factors and market dynamics. Analysts are disagreed with whether BTC can continue to rise or fall. However, there are five influences that you should consider in the Bitcoin market this week.

1. Bitcoins fight with the main resistance

Bitcoin has been testing this resistance for months and is under a long -term trend line that limits the upward trend. Despite an increase of 6.7% last week, BTC is still facing a major hurdle that needs to be overcome. According to Bitbull, Bitcoin rejected at the key resistance, and when it breaks through, BTC will return to the support area of $ 70k $ 72k.

Analyst Rekt Capital has the uncertainty around the outbreak emphasized. Bitcoin has briefly closed over the trend line, but confirmation of the outbreak is still pending.

If Bitcoin can test and keep this resistance again, the analysts $ 88k or $ 81K see as possible goals, depending on how the market reacts. However, if the resistance keeps, a relapse to lower support levels is possible.

2. Global trade conflict

The trade war between the United States and China puts the global markets under pressure, and Bitcoin is no exception here. As CNF reported, the market reacted violently at the weekend when President Donald Trump announced customs exemptions for important technology products and Bitcoin briefly drove over $ 86,000. However, the optimism was short -lived when it was made clear that the exceptions are not permanent, and Bitcoin fell back to about $ 84,000.

These customs announcements have increased market volatility, and Bitcoin is very sensitive to new developments in the trade war. While there are only a few US data this week, analysts expect global trade questions to dominate the mood.

Kobeissi Letter said that The temporary customs exemptions should calm down the markets before the trade war intensified. The goal was to lower the returns of government bonds, but geopolitics are far from over.

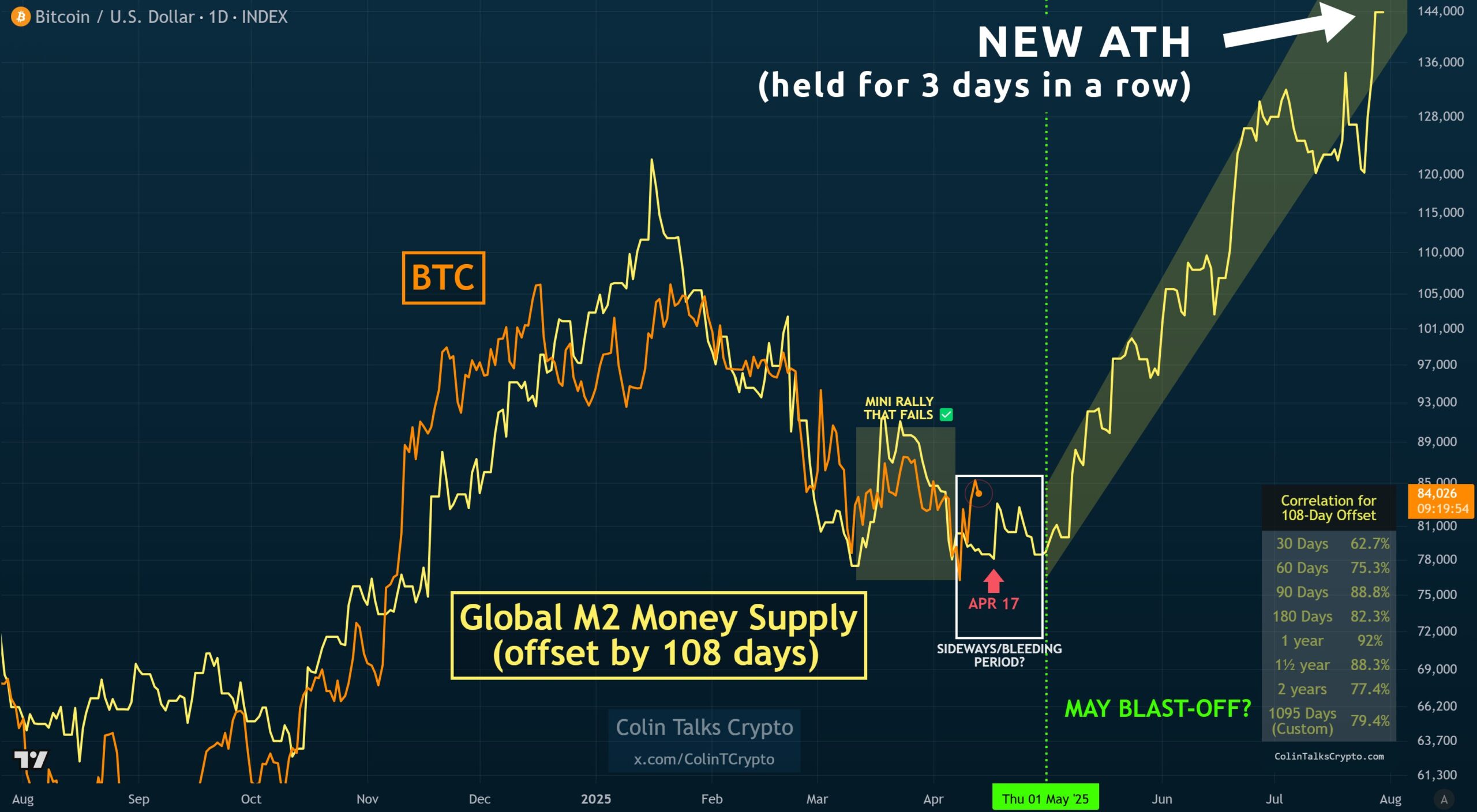

3. Increasing M2 money quantity: thrust for Bitcoin?

The M2 money supply has reached an all -time high, which is a good sign for Bitcoin. M2 is a wide range of money supply, which includes cash, giro deposits and easily convertible assets. Colin Talks Crypto Fixedthat M2 was high for three days in a row, which could mean upward pressure on Bitcoin in the coming months.

Bitcoin shot up after a significant increase in liquidity, and the growing M2 offer could provide liquidity to promote a price increase. However, the effects of this trend could not be direct.

Colin said that A big rally will probably not take place before May 2025, since the liquidity of M2 will then begin to affect risk systems such as Bitcoin. Dealers will observe this trend closely because the rising money supply could be positive for Bitcoin in the long term. But the market may not react immediately to the increasing liquidity and every price movement could be delayed.

4. Bitcoin ETF drainage: minimal effects

Bitcoin ETFs have been experiencing considerable drains recently, with more than $ 750 million leaving Bitcoin ETFs on the USA. Still says says ,Economist Timothy Petersenthat the effects on the Bitcoin market are minimal. SElt large drains such as a nine -digit amount in view of the increasing market size and the global influence of Bitcoin would have little effect on the market.

An actor on the Bitcoin market is Microstrategy (now strategy) that despite the latest volatility furthermore Bitcoin bought. CEO Michael Saylor’s company resumed the purchase of BTC after a short break in early April. As CNF reported, the report by Microstrategy showed from its Bitcoin stocks for the first quarter of 2025 not realized losses of around $ 6 billion.

5. Dollar weakness could be good for Bitcoin

The US dollar has recently come under pressure and has reached 3-year lows compared to the most important currencies. This could be an opportunity for Bitcoin and other risk systems. Historical trends show that Bitcoin is doing well when the US dollar index (DXY) sinks, but the effects of foreign exchange movements need their time.

Markets selling dollar even lower Monday. DXY fell through 100 and also the 2023 low over last few hours, now at lowest in 3 years pic.twitter.com/MJ8wvvJuY2

— David Ingles (@DavidInglesTV) April 14, 2025

Since the DXY approaches the deep stalls, Bitcoin could be loud Bitcoindata21 Experience a big upswing, similar to 2017. The decline in the dollar could lead to an increased demand for alternative assets such as BTC, as fears of inflation and global uncertainty drive investors to assets with a limited offer.

As CNF reported, Grayscale Research also sees a chance in the current position of Bitcoin and compares it with gold in the 1970s. Since traditional currencies lose value, Bitcoin and gold will be in demand as value preservatives in a chaotic financial world.

No Comments