Bitcoin reaches $ 83,000 with chances of $ 92,000 Bullrun in front of a emerging cunning crisis crisis

- Bitcoin increases again to $ 83,000 in the middle of US market turbulence, with a possible rally towards 92,000 likely becoming likely.

- The Bitcoin Futures market shows growing optimism, while a short squeeze BTC could drive towards $ 92,000.

After a brief slump to $ 81,500, Bitcoin has recaptured the $ 83,000 mark and thus defies the general decline in market. This is done at a time when the entire US market is faced with a loss of $ 2 trillion, which is largely due to the escalating customs war between the USA and China.

How CNF reportedthe tariffs of President Donald Trump against China caused uncertainty in the global markets. The announcement of a 34%customs on all US goods through China caused the Bitcoin course to break in. Analysts now speculate whether Bitcoin continues to rise and possibly reach the $ 92,000 mark because the technical indicators show upward moment.

Bitcoin forms a positive triangular pattern

Bitcoin fluctuates within a symmetrical triangular pattern, with the course $ 81,595 and $ 88,357 commuting. On the 4-hour chart, these fluctuations indicate that the cryptocurrency consolidates before it takes up its next major movement.

The formation of a morning star pattern near the support trend line is rated as an interest bully signal and indicates a possible reversal soon.

The technical indicators support this outlook. The RSI (relative strength index) has increased steadily and is now above the 50 mark, which is usually a sign of increasing buying pressure.

The MACD indicator (Moving Average Convergence Divergence) also shows a positive divergence, with the Bärische Histograms smaller. If this trend continues, Bitcoin could break through the upper trend line of the triangle and test the resistance at over $ 86,000.

The market participants observe this pattern closely because an outbreak could trigger further purchases via the $ 86,000 mark. However, if the support does not last at $ 81,595, there could be a deeper correction.

Bitcoin futures and ETF drains: mixed mood

The Bitcoin Futures market has shown signs of a positive mood in the past few days. The long positions have increased significantly, which means that Ratio of Long to short from 47.18% to 51.06%.

This shift indicates that more dealers bet on an increasing Bitcoin course, which reflects a growing optimism. In addition, the open interest in Bitcoin futures rose by 0.75 % and achieved a total amount of $ 52.43 billion.

However, an opposite trend can be observed in the Bitcoin ETFs. On April 3, the Bitcoin ETFs recorded a massive drainage of $ 99.86 million. With a loss of $ 60.20 million, Grayscale recorded the greatest drainage, followed by BitWise, which lost $ 44.19 million. Despite these drains, Blackrock recorded tributaries of USD 65.25 million, which indicates that some institutional investors are still positively set to Bitcoin.

Short-Squeeze potential could bring Bitcoin to $ 92,000

A key factor that could accelerate Bitcoin’s price increase is a short squeeze. With the increase in the long-short ratio, Bitcoin becomes more susceptible to a squeeze in which levered short positions are dissolved when the price increases.

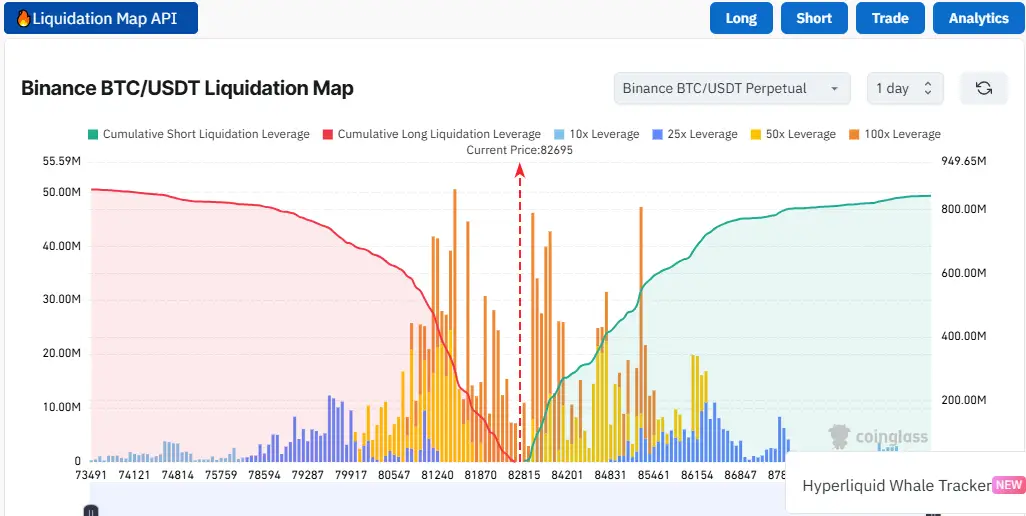

Die Binance BTC-USDT Liquidations-Bitcoin-etfs Show: If Bitcoin exceeds the value of $ 83,555, short positions worth over $ 100 million could be liquidated, which would lead to further price increases.

This scenario is particularly interesting because it indicates that BTC could break through the level of resistance faster than expected. In this case, the course could quickly approach the $ 92,000 mark, with a possible increase due to the liquidation of overvalued short positions.

According to analysts, a short squeeze could cause a rapid increase in price that reaches new highs and possibly create the prerequisites for Bitcoin to get into the zone of its last ATHs. However, the recent movements of long -term investors who have sold over 1,000 BTC indicate profit.

How Analyst Ali Martinez stated this has increased the overall offer, which could put pressure on the BitcoIN course, especially if there is a larger market correction.

In this case, Bitcoin could fall under the current support of $ 80,000, whereby $ 78,350 could serve as the next support. If there is a short squeeze, he could drive the course up, possibly up to $ 91,600.

No Comments