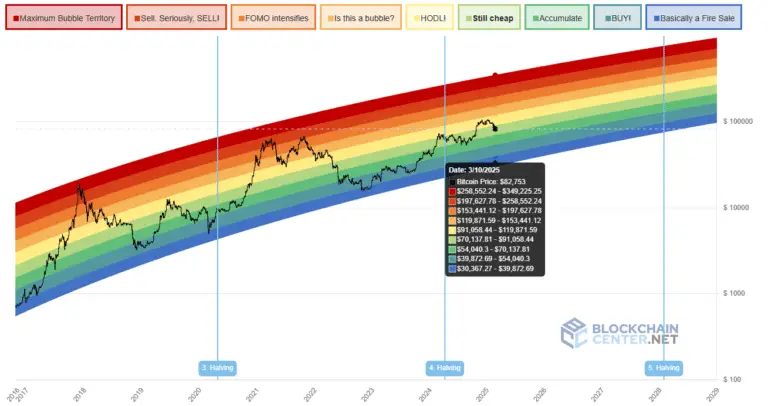

- The Bitcoin rainbow chart shows that the course is still in the basement because it imitates the bull cycle of 2021, in which the RSI was over 70 for weeks before it returned.

- Meanwhile, Standard Chartered believes that Bitcoin will fall below $ 80,000, since the economic weakness continues to affect trust.

Bitcoin (BTC) has suffered losses in all remarkable trading sessions and has fallen by 0.77 % in the last 24 hours, by 2.5 % in the last seven days, 15.8 % in the last 30 days and 16.7 % in the last 90 days to act at $ 81.5K at the time of going. However, the analysts are still optimistic because they observe interest bullic patterns in some reliable market indicators.

Bitcoin kursa

When analyzing several theses of renowned dealers, we found that the Bitcoin price is “still cheap”. In fact, the analyst Samson Mow believes that the asset could reach the $ 1 million mark in 2025 – CNF reported.

The possible upswing from Bitcoin is confirmed by the Bitcoin Rainbow Chart, which is represented by a logarithmic growth curve with rainbow colors, which shows the long -term trend. When looking at the movement in the last two cycles, we found that the curve touched the area “seriously selling seriously” area. However, this is not the case in this cycle. The curve is still moving in the “possible bladder” area. Interestingly, the values of the relative strength index also indicate a imitation of the cycle of 2021.

In 2017, for example, Bitcoin’s weekly RSI value was over 70 for several weeks, since the asset reached several highs during this period. However, the asset and the RSI in 2021 recorded a bearish divergence before falling by almost 50 %. The market later recovered and entered another declining phase.

In the current market cycle, the RSI was over 70 for a total of six weeks before falling under the neutral zone of 50 in the fall. Fascinatingly, this reflects the correction of 2021 when the asset decreased by 50 %. A similar decline could press Bitcoin to $ 54,000.

When comparing the cycles based on the BTC.D, we also found that this key figure reached almost several months during the last two cycle depths. The value is currently at a level that has not been reached in the past four years. This is fascinating with a recent analysis of a cryptoquant employee, Ibrahim Cesar. In his last thesis, he predicted that Bitcoin could rise to $ 180,000 again. According to him, Bitcoin’s latest movement reflects the former bull cycles:

“In summary, it can be said that those who invest in Bitcoin at these levels have the potential to win over $ 100 % without waiting for a year. If you buy in the right regions and at the right time, you can take considerable opportunities. “

Position von Standard Chartered

Regarding the current trend, Standard Chartered predicted another “massacre” because her analysts predict that Bitcoin would take a decisive step below $ 80,000. Several factors are mentioned as reasons, including the concerns about inflation, interest rates and economic policy in the United States.

Standard Chartered also believes that Bitcoin could experience an upswing and reach $ 500,000 by 2029. As indicated in our previous discussion, the bank assumes that this significant development is powered by institutional investors, hedge funds and sovereign funds.

No Comments