- Bitcoin’s on-chain appears bearish or late-cyclical. For a technical reversal, BTC needs to recapture $93,500.

- Liquidity tailwinds (rate cuts/QE) are countered by OG/LTH selling pressure.

Bitcoin enters the second week of January 2026 with positioning headwinds, weak flows and a chart picture where bears will prevail unless key resistance is overcome. In his latest Newsletter writes Capriole Investments CEO Charles Edwards that strong macro tailwinds are currently being met by Bitcoin’s striking underperformance.

Edwards currently sees the “biggest headwinds” in the relative weakness compared to other major asset classes such as gold, silver and the US stock market. A main reason for this is the long-term holders (LTH) of Bitcoin and their ongoing selling pressure.

Why Bitcoin Needs to Reclaim $93,500 Now

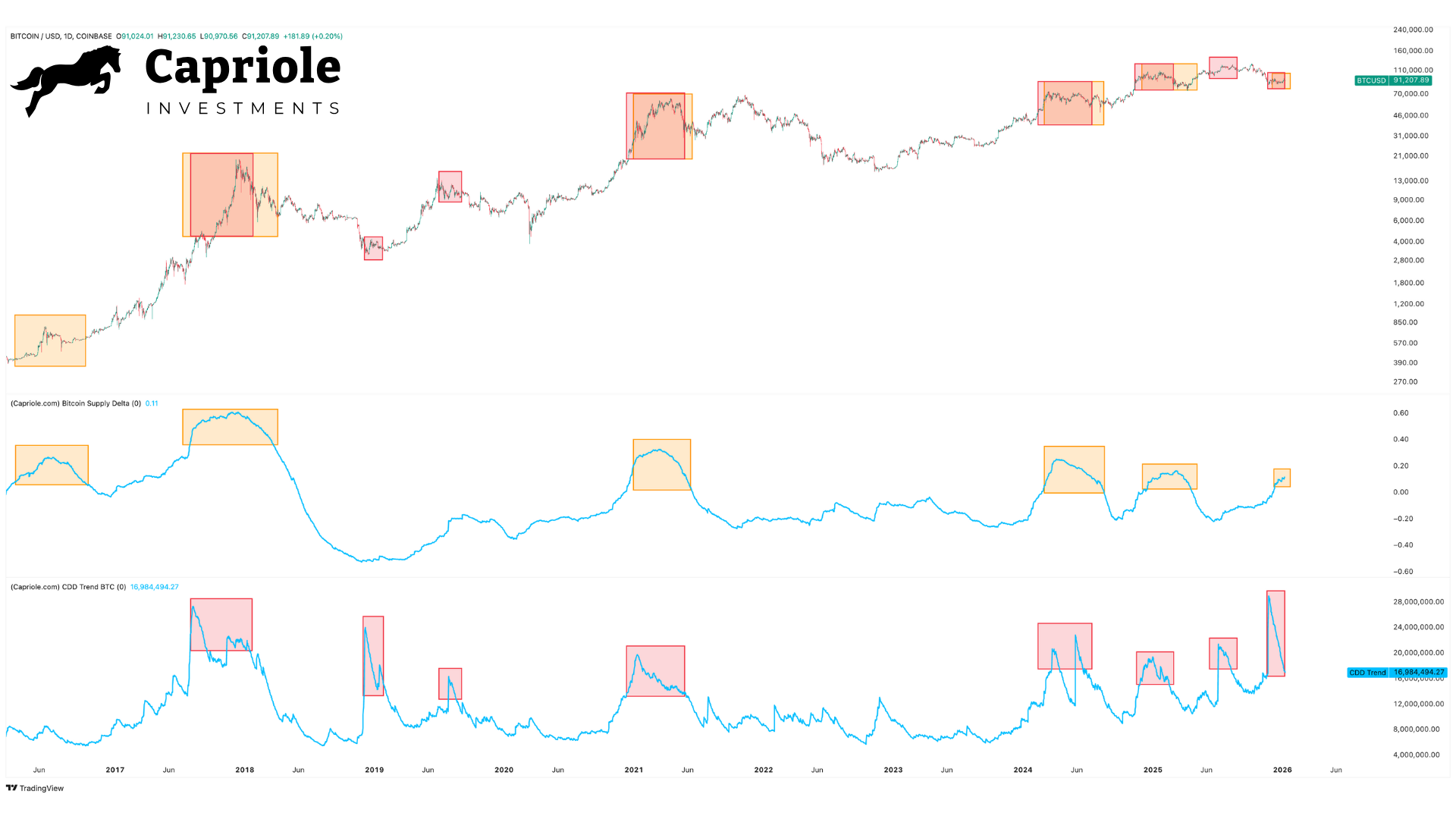

Edwards points to rapid increases in the CDD trend and supply delta, which historically often coincided with periods of volatility and “often correlated with large price tops.” Supply delta peaks indicated a growing share of short-term versus long-term holders; A rising CDD trend signals that “older coins” are being increasingly moved and sold again. “Currently, both metrics are cause for concern,” said Edwards.

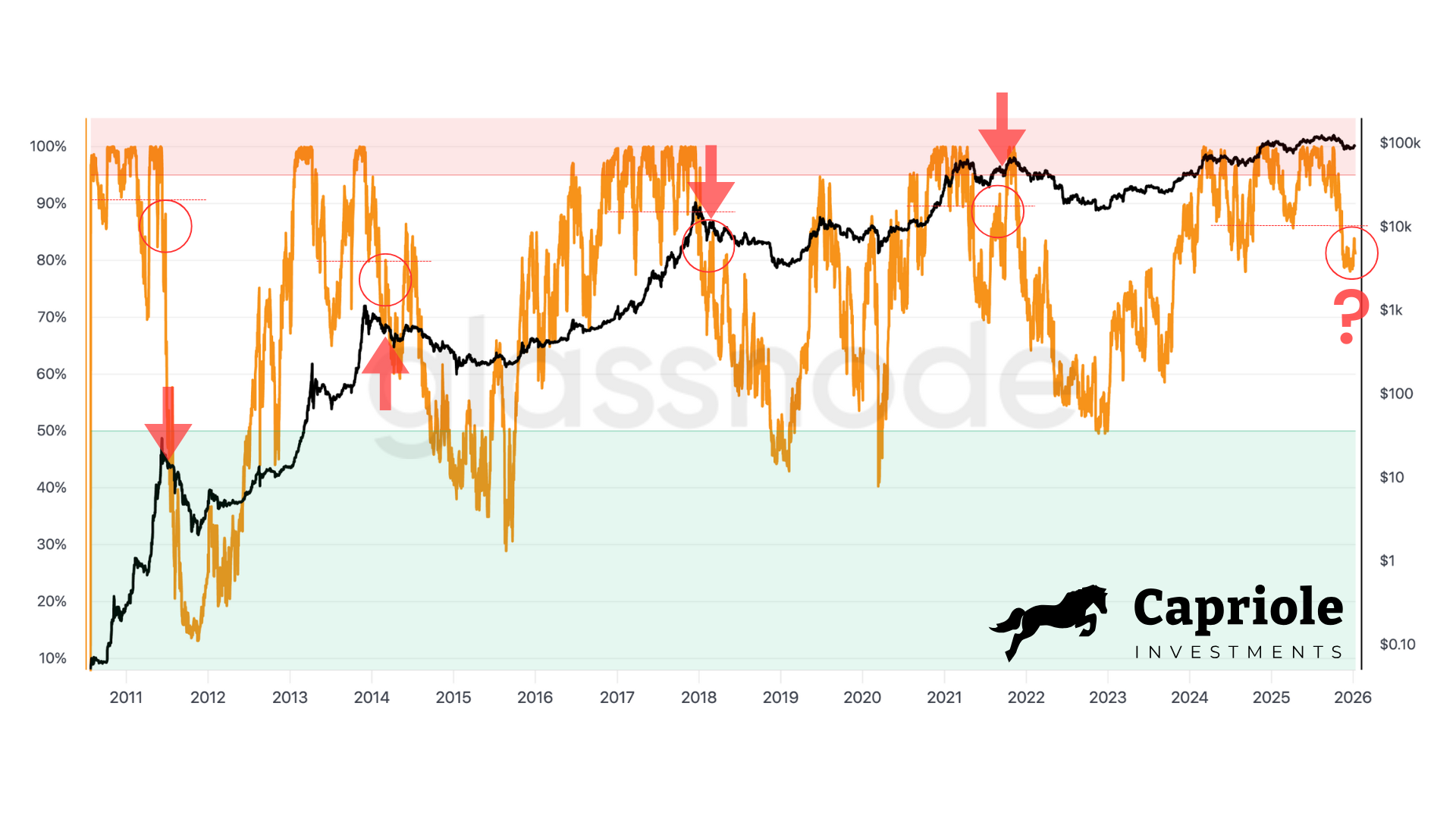

The second main reason is profitability in the network. In strong bull phases, the percentage of Bitcoin addresses in profit is typically over 80 to 90 percent. According to Edwards, things become critical if the indicator breaks structurally and re-tests fail. But this is exactly what is happening at the moment:

As more and more investors become less profitable, the price trend by definition weakens. The graphic below highlights all important dips in the profitability trend as well as failed re-tests after a longer period of high profitability – similar to the current situation. These events have historically all occurred within a few months of the peak of the major cycle.

From a chart perspective, the central mark is $93,500. A breakout above this price would be the first milestone for Edwards to break the ongoing downtrend. A weekly close above this zone could then open the way towards $100,000 and above, supported by a confirmed “false breakdown” thesis.

Until then, the technical bias remains bearish. For Edwards, two price signals are particularly relevant: firstly, Bitcoin’s Electrical Cost (BEC) at $59,010 and secondly, the Production Cost (BPC) at $74,039. Edwards calls the price area the “deep value” zone. However, demands for prices well below $60,000 are “unreasonable” in the current context.

On the fundamentals side, Edwards describes a tension: flows, OG selling and PnL metrics appeared “bearish or late-cycle” and historically painted a “concerning 12-18 month outlook.” At the same time, several classic on-chain valuations showed a value zone, such as the Bitcoin Yardstick and Dynamic Range NVT.

On the macro side, Edwards lists an environment that favors liquidity: interest rate cuts, quantitative easing (QE) restarting at “$40 billion per month”, a CPI below 2 percent, higher unemployment and political catalysts. Edwards writes:

“All of the factors mentioned provide considerable support for liquidity and the Bitcoin price. Bitcoin actually has no excuse not to perform above average in this environment. Maybe that’s exactly what we’re facing? The Bitcoin OGs may reduce the selling pressure and thus lay the foundation for a second upward wave in 2026. 2026 could be the year in which Bitcoin catches up with gold’s massive $10 trillion market capitalization gain over the last twelve months. We think this scenario is quite realistic.”

The biggest structural headwind in the argument is quantum risk. Edwards speaks of a necessary fair value discount: “Now that we have reached the quantum hack event horizon, we need to discount the fair value of Bitcoin today accordingly. Currently we need to reduce the fair value by 20 to 30 percent.” As an example, he cites an Energy Value estimate of $148,000, which according to Discount would be “more like $118,000” until a credible roadmap for a quantum-resistant upgrade is in place.

No Comments