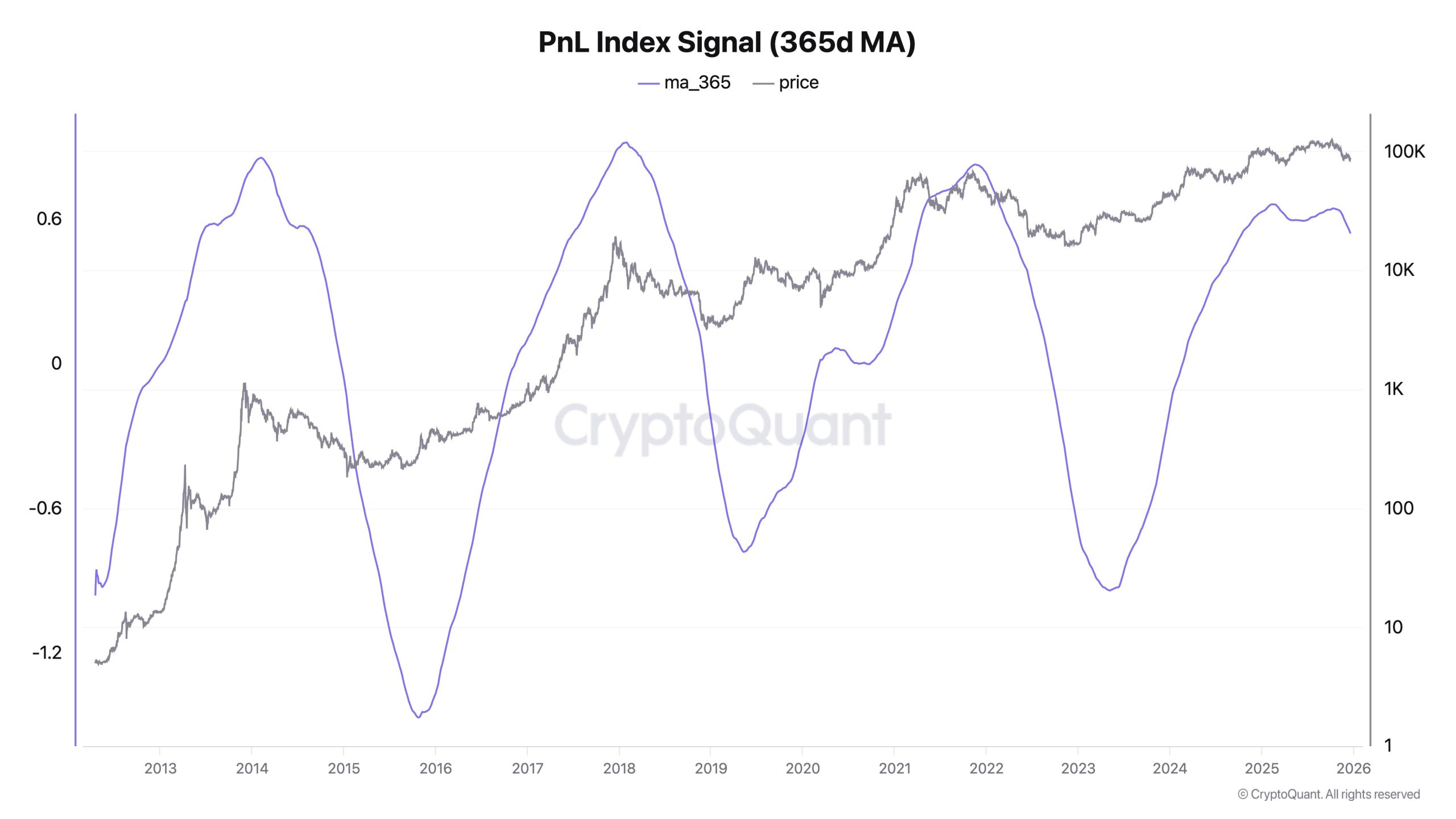

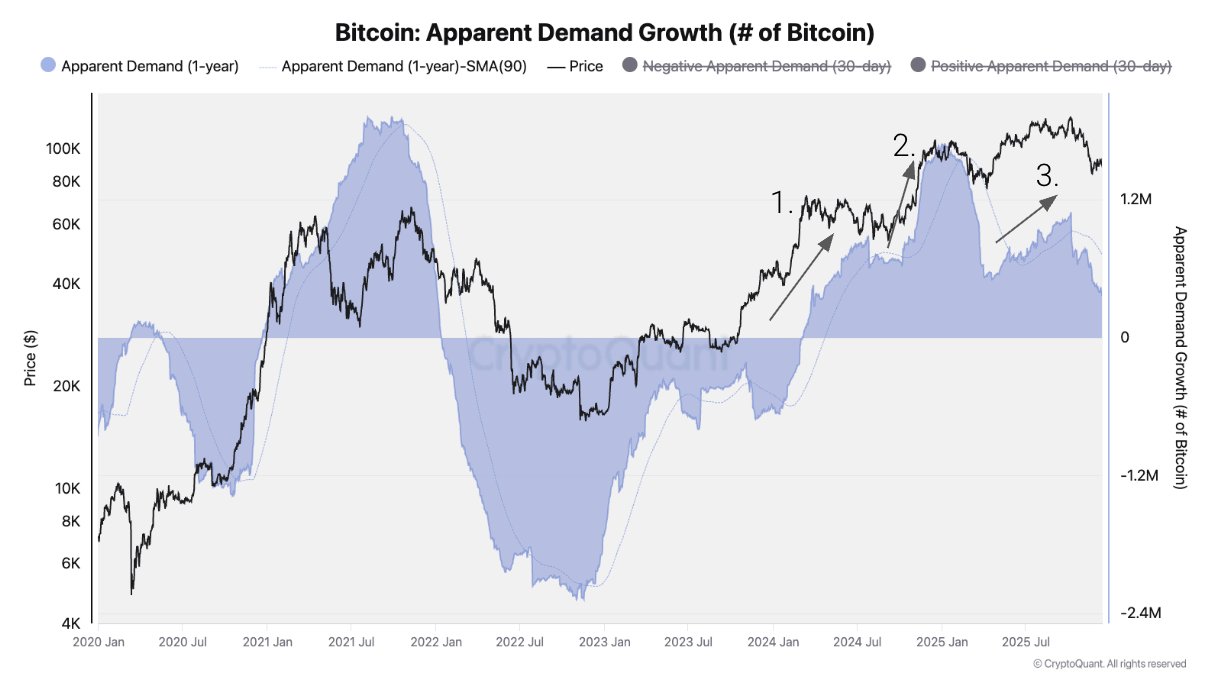

- CryptoQuant sees slowing capital inflows and significantly slowing demand growth for Bitcoin, including weaker institutional/whale dynamics.

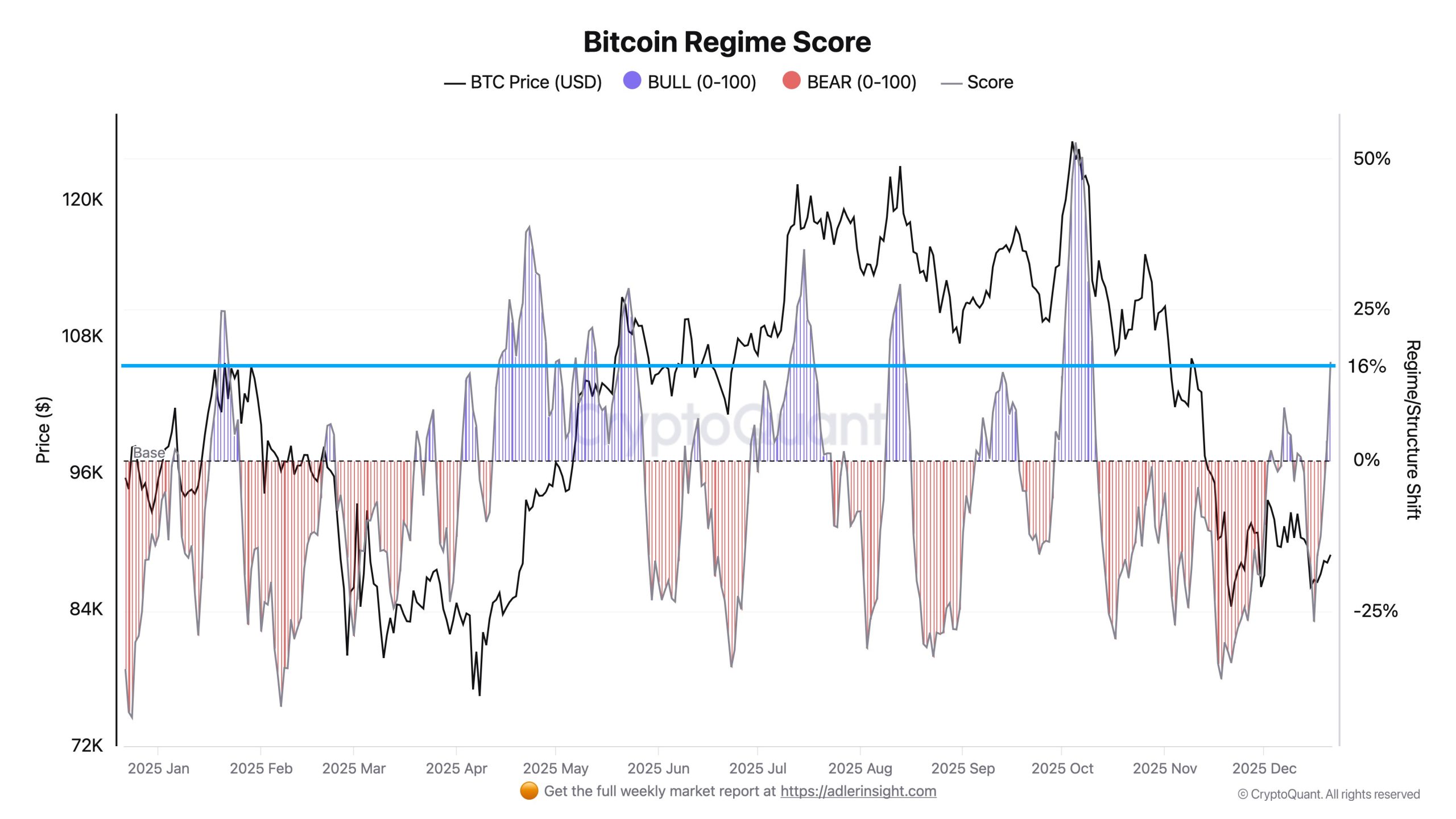

- The regime score is positive and a short liquidation wave could trigger a mechanical year-end boost at the end of December.

After crashing to almost $80,000, the Bitcoin price is still in the discovery phase. While bearish voices continue to grow on crypto Twitter, the data is not clear.

On the one hand, the on-chain inflows are weakening, the demand side seems tired. On the other hand, the current derivatives flow could provide exactly the kind of boost that is often called the “Santa Rally” at the end of December, even if technically it looks more like a liquidation mechanic.

The bearish argument for Bitcoin

CryptoQuant CEO Ki Young Ju wrote on Sunday evening on

The leading on-chain analysis company already had a new one last Friday Message published, which can clearly be assigned to the bearish side.

“Bitcoin demand growth has slowed significantly, signaling a transition into a bear market. After three major waves of spot demand since 2023 – triggered by the US spot ETF launch, the US presidential election result and the ‘Bitcoin Treasury Companies’ bubble – demand growth has fallen below trend since the beginning of October 2025.”

And further: “This suggests that the majority of the incremental demand of this cycle has already been realized, thus removing a key pillar of price support.”

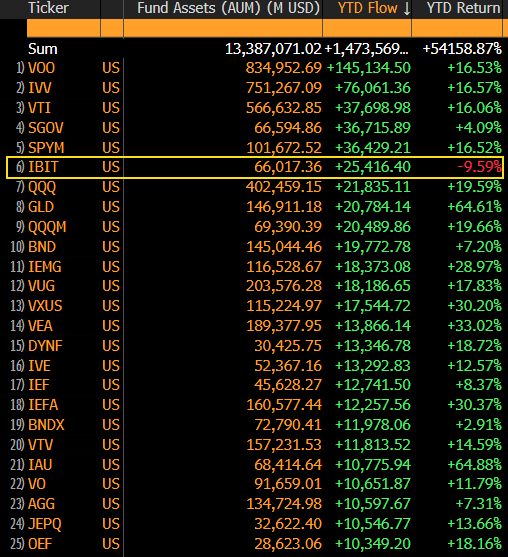

Another observation from the analysis company is also very bearish. “Institutional and large holder demand is now shrinking instead of growing. US spot Bitcoin ETFs have become net sellers in Q4 2025, with holdings down by 24,000 BTC – a sharp contrast to the strong accumulation in Q4 2024.”

In addition, there is the observation that addresses in the 100-1,000 BTC range are growing “below trend” and that looks more “like late 2021” than a fresh bull market. In short, the flow data doesn’t sound like the start of a new rally, but more like a tough bear market.

The bullish argument

However, a look at the derivatives market still gives hope in the short term. Verified CryptoQuant analyst Axel Adler Jr. writes today via

In his „Morning Brief“ (#66) he adds, and it gets heavy on numbers, but good. “The BTC market is in the upper part of the regime score neutral zone, which has historically shown positive expected returns. The current liquidation structure in the futures market suggests a dominance of short closes, which creates additional mechanical pressure in favor of buyers.”

According to the letter, Adler’s regime score is +16.3, i.e. in the +15 to +30 zone. His backtests for 2025 show: in this subzone BTC rose by an average of +3.8% over 30 days, while the -15 to 0 zone brought negative prices. When it becomes “too bullish” (>30), it often becomes dangerous.

“An important point from the backtesting: the transition into the formal bull regime (+30 and above) has historically coincided with local tops and delivered negative average returns of −3.3% over 7 days.” However, the score currently shows bullish potential: “This means that the current zone of +15 to +30 could be optimal for tactical positions”

The US ETF market remains the most important demand driver for the Bitcoin price and sounds less like a bear market than like long-term adoption.

Senior Bloomberg-ETF-Analyst Eric Balchunas wrote on Friday via

And then the sentence that sticks: “That’s a really good sign in the long term, in my opinion. If you do $25 billion in a bad year, imagine the flow potential in a good year.”

No Comments