- The BitcoIN course has slipped under $ 104,500 and arouses fears of a further decline.

- Wal transactions and on-chain metrics indicate Short -term stagnation despite very good long -term fundamental data.

The Bitcoin course fell 8% and thus under the support at $ 104,500. The decline dropped the course almost $ 9,000 and triggered uncertainty.

The increase, which brought Bitcoin to his ATH of $ 112,000, was due to the expectation that the US tariffs would not get into force. The news that a federal court declared the tariff on May 28 to be unconstitutional brought into the market. But now a Federal Court of Appeal has tipped the decision of the lower court.

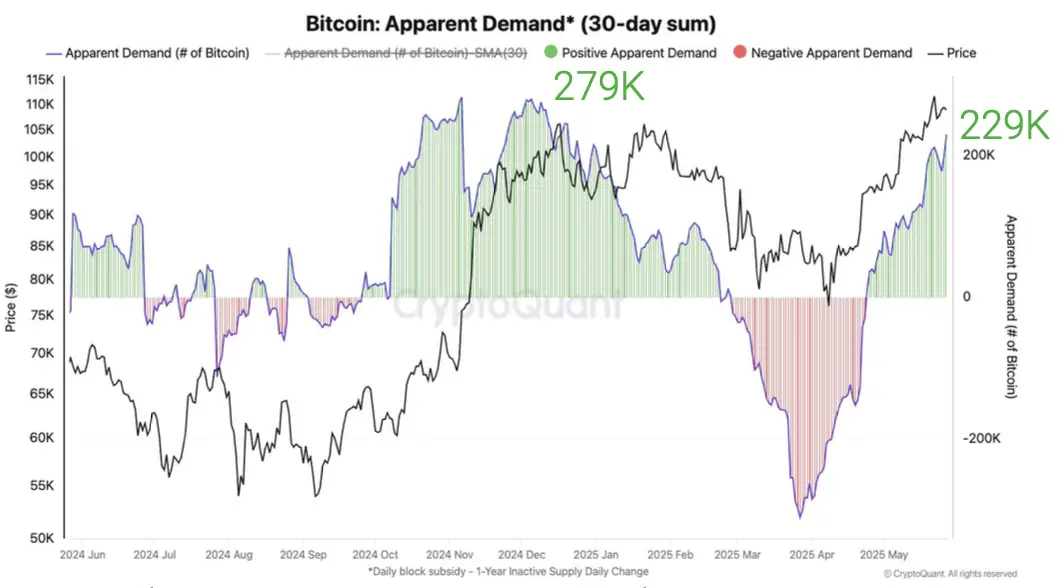

According to the data from Cryptoquant, the growth of Bitcoin demand enters into a stable phase, as it is around 229,000 compared to the Highest stand of 279,000in Decemberwhich corresponds to an increase of 30 days. On the other hand, the average unrealized profits have dropped by $ 111,000, which is a sign of the end of the trend.

The market is still optimistic, with the price targets from June essentially predominate, so that another increase is predicted, albeit with short -term restrictions.

Wal movements crowd sentiment move market dynamics

There was an increase in Wal activities as well more than 18,000 transactions above 100.000 Dollar were recorded in one day as the Bitcoin course 112000 achieved. Such a volume was During the Inauguration Trumpsobserved and is a clear indication that size Actor included be mightto sell their assets. It is common for changes in the market trends Such actionsprecedeand with this case, this is perfectly true.

A Santiment report showsthat the mood of people in the past week has shifted from extreme greed at the top to a state of fear at the base. On 22.May , When BTC reached its maximum, there was greed for most social media platforms. The picture changed within just three days, and on May 25th As the prices on 106000 dollars had droppedthe fear won quickly again The upper hand.

Trader Mags rightly pointed out thisthat BTC has only lost its all -time high on the daily -type, but on the weekly chart It stays over it so that this Weekly is of enormous meaning. If the support is not reached againthis could mean a deeper correction and probably the formation of an inverse head and shoulder pattern.

Over and beyond Will the levered long position a whale Distributed in the amount of $ 1.2 billion if BTC under 104.810 fall, and hat thus The potential for a weak market trend.

#Bitcoin just broke down ! Is the bull run over?

On the daily chart, BTC has broken below the previous all-time high and is facing rejection at that same level. This might look like the start of a deeper correction

But on the weekly chart, price is still holding above the… pic.twitter.com/04RuArVYhf

— Mags (@thescalpingpro) May 31, 2025

Investors want to keep BTC in the long term

Despite a sudden outbreak of sales, in which it act on short -term pressure could, interpret the continuous Detail of several long -term key figures that the Undercurrent of asset very strong is . Such an indicator is the fact that the Bitcoin offer on the stock exchanges keep going back.

Since January were more than 147,000 BTC removed, was indicates thisthat the investors their assets nun want to consider it long -term. The is a typical pattern that usually means that A strong belief in course increases.

In addition, Bitcoin’s medium-sized $ 426 days drops to Bitcoin and is therefore below the old record of 443 days. This shift showsthat old stocks are back in the market, a situation, at the Early investors usually Take the profits with you and get new investors.

Since July 9th now when The next crucial date for the decision about the US tariffs applies, should Dealer die Mood on Market, the activities the Whales and dieKey indicators of the On-Chain-Metriken Exactly keep an eye on.

Is at the same time Expert Ash Crypto of the opinionthat a decline in the course of the Upward movement von Bitcoin After a golden cross is a usual phenomenon.

It was In the 4th quarter of 2024 observedWhen the course broke up 10% before it added 62% in the medium term. Athere is a similar pattern with an immediate BTC decline of 8%. Ash Crypto sees the low point here, DAher the reference to soon recreation.

No Comments