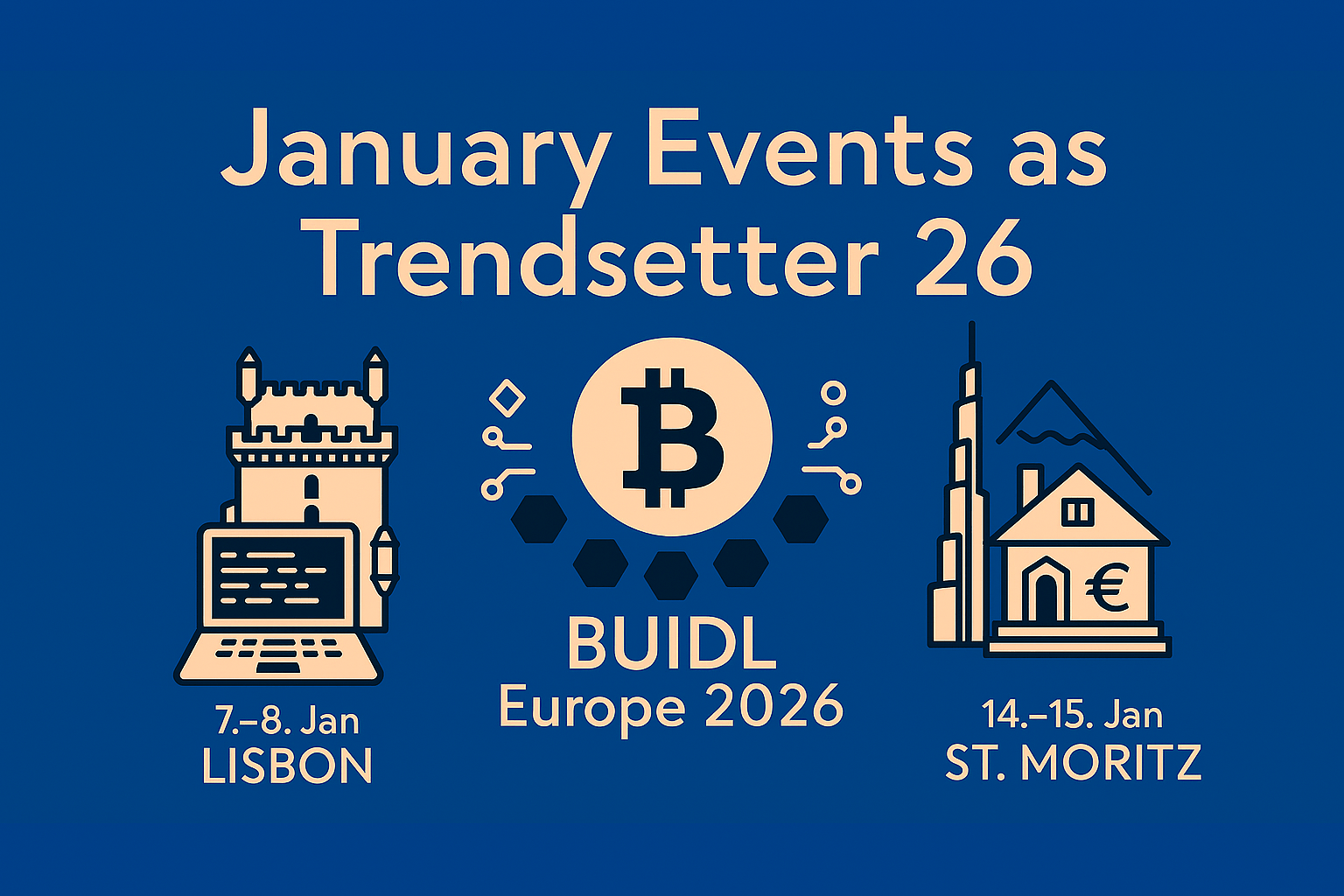

- 2026 begins with three events that could hardly be more different: a technical builder meeting in Lisbon, a global Web3 expo in Dubai and an exclusive institutional summit in St. Moritz.

- Together they set the agenda for the crypto industry with topics that will define the year: infrastructure, tokenization, regulation and institutional adoption.

Die BUIDL Europe remains true to its claim of being an event for doers. The conference is aimed at developers, protocol teams and founders who work on the technical basis of Web3.

7–8 January: BUIDL Europe Lisbon – The path to the web3

The focus is on new Layer 2 architectures, zero-knowledge technologies, interoperability and the question of how Web3 applications can be scaled without losing their decentralization.

The intention of the event is clear: less marketing, more code. Lisbon is once again positioning itself as a European center for Web3 development. The impact is traditionally noticeable because many projects deliberately set their technical roadmaps, toolkits or protocol upgrades for this date.

For the market, this means: new standards, new narratives and often the first signals about where the infrastructure is heading in the new year.

January 14th to 15th: Web 3.0 Expo Dubai – Tokenization and AI

Dubai uses this Web 3.0 Expo as a stage to consolidate its role as a global Web3 location. The event is much broader than BUIDL Europe.

It attracts startups, AI companies, gaming studios, regulators, investors and media. The intention is to showcase the fusion of tokenization, artificial intelligence, digital identity and DeFi while underlining Dubai’s liberal regulatory ambitions.

The impact of such expos is less technical and more geopolitically and economically relevant. New partnerships are emerging, tokenization projects are announced, and the MENA region is providing momentum that is increasingly being perceived globally.

For investors, Dubai is an indicator of which topics are gaining regulatory and economic tailwind – particularly RWA tokenization, AI-powered protocols and Web3 gaming.

January 14th to 16th: CfC St. Moritz – setting the pace for institutions

The CfC St. Moritz remains one of the most exclusive crypto events worldwide. The list of participants consists of family offices, banks, asset managers, regulators and founders. The intention is not public visibility, but rather confidential exchange about regulation, macro trends and institutional strategies.

The impact of this peak is subtle but significant. Many regulatory and institutional trends that become big later in the year arise here in a small circle. Switzerland is using the event to strengthen its position as a regulated, yet innovation-friendly location in Europe.

For the market, this means: signals on ETF structures, custody, compliance standards and institutional capital flows. What is being discussed in St. Moritz has influenced the strategic direction of major investors more than once.

No Comments