Bitcoin course falls 4% after Record-Ath-with it the entire cryptoma market loses

- Bitcoin lost over 4 %after he reached his record high, triggered by profit from winning and a conjuncrojudgment.

- The wider cryptoma market saw red, despite strong institutional tributaries and low sales pressure on the stock exchange.

Bitcoin fell dramatically on Tuesday and gave up the winnings of the past few days after reaching a new high of $ 123,091.6. The sudden correction reduced the price in intraday trading by 4.13 % to $ 116,814.80. This happened when most investors despite generally positive indicators both in the institutional streams as well as with the On-chain indicatorsProfit .

In July, tributaries in Bitcoin ETFs worth $ 3.4 billion were recorded, including 2.2 billion in two days, reported CoinSwitch Markets Desk. However, almost $ 100 million were deducted on Monday, which led to a temporary change in mood on the market. It led to the increase of the open interest at the Bitcoin futures, which means that are still involved.

Technical indicators indicate the development of an inverse Head and shoulder structure at Bitcoin. Solange There is still a basis for support near $ 113,000, there is still the possibility of a breakout towards $ 148,000.

Nothing was spared, not even Ethereum, which after a short touch of a five -month high fell by 2.8 % to $ 2,968. Solana fell 4.4 %, Dogecoin by 7.7 % and Cardano by 4.8 %, while Stellar lost 10 %.

Institutional trust despite the Bitcoin decline

Despite the sudden correction, the mood among institutional investors is still not bearish. The co -founder of PI42, Avinash Shekhar, explained that this type of correction was a typical market behavior after one good Upward movement is . In his opinion, this correction does not show any signs of a trend reversal, but is a healthy correction.

Srinivas L of 9Point Capital said that strategic opportunities arise for long -term buyers in this correction. He believes that consolidation is due at these high levels, but the general structure still speaks for an outbreak.

Edul Patel, CEO of Mudrex, found that the aggregated crypto market capitalization in just one week a 16 % has risen to $ 3.88 trillion. The inflows an den Bitcoin exchanges have been at the lowest level since April 2015, what on a low sales pressure On the part of the ownerindicated.

US inflation and tariffs put crypto market under pressure

Macrotrends have the cryptoma market alsocharged . Dealers expect inflation data from the USA, where the consumer price index is to increase by 2.6 % in the year. A weaker as expected would revive the bulls, but The willingness to take risks By announcing US President Donald Trump to raise a 100%customs on Russian importsshaken.

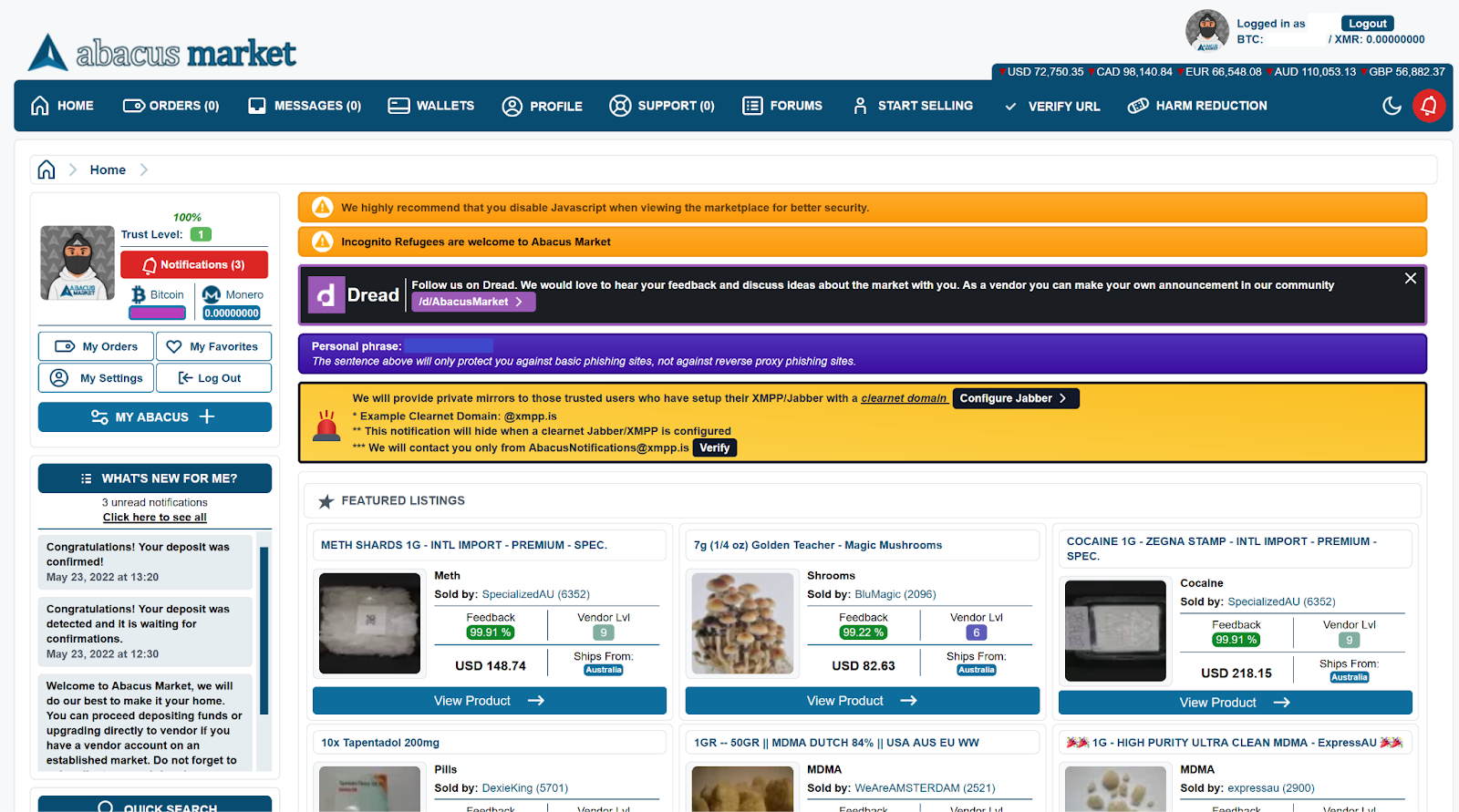

At the same time, one of the largest Darknet markets operated by Bitcoin, Abacus Market, was switched off. TRM Labs discovered signs of exit fraud after users complained about several weeks. The sudden disappearance of the website follows similar Closets of Darknet markets In June, including archetype Market.

Meanwhile is reported,thatThe Kazakh national asset fund Crypto investments examined in reserves. The Kazakh central bank learns from global approaches, including Norway and the USA to find out how she Add cryptocurrencies in your portfoliocan. The country is also interested in setting up a reserve for digital assets with confiscated crypto stands.

No Comments