- The most recent increase in Bitcoin Over $ 110,000 signals strength again, but the course continues to react sharply to economic triggers.

- In focus with inflation data, interest changes and ETF inflows Could the next phase des BTC From global Financial shifts be determined.

Bitcoin ended the week in a significantly better mood after recovering from the previous unsuspecting performance, and settled at $ 109,100, with which he almost reached the high in January and marked a significant reversal after testing the area of $ 107,000.

Nevertheless, Bitcoin on a weekly basis has to take a strong increase over the old highs so that dealers are in a better position. The current price structure indicates that there is an outbreak – but the actual question is how to proceed.

If the level of support is held and the economic factors for Bitcoin speak, the course will likely be Over $ 155,000 climb.

$BTC has completed the breakout. Now it’s about follow-through.

⁰Clean breakout from consolidation, retest underway.If this structure holds, the next target zone is ⁰$155K in sight —

Momentum only needs a trigger. pic.twitter.com/DiGdeEaz69

— BitBull (@AkaBull_) May 25, 2025

Inflation, interest and the ceasefire in the EU inches’ war

One of the most important key figures of the week is the index of personal consumption expenditure in the USA on May 29. It is a meaningful indicator for the effect of inflation, which may Monetary policy the Federal Reserve Bank certainly.

The bond market already recorded an increase due to the news about the tariffs, in particular the message about the pushed up 50% inches to products from the EU until July. The market seemed to react that the return of the 10-year bond quickly increased to 4.55 %.

With the increase in interest rates pressed The market It is worried that the prices remain at the same level and that the interest could be high in the medium term. Die Fed pursues a strict politics – the bank holds on the interest rates and there was no clear signal for an end to the rate increase.

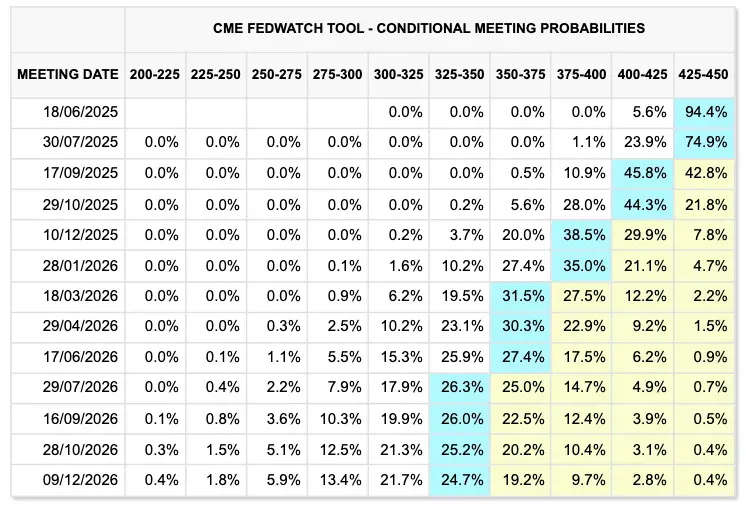

The CME FedWatch-Tool there is none Possibility of interest reductions until at least September. As a result, Bitcoin and other cryptocurrencies that belong to the risk systems could experience a hard time, especially if inflation is even higher than expected.

Bitcoin exchange activity allows

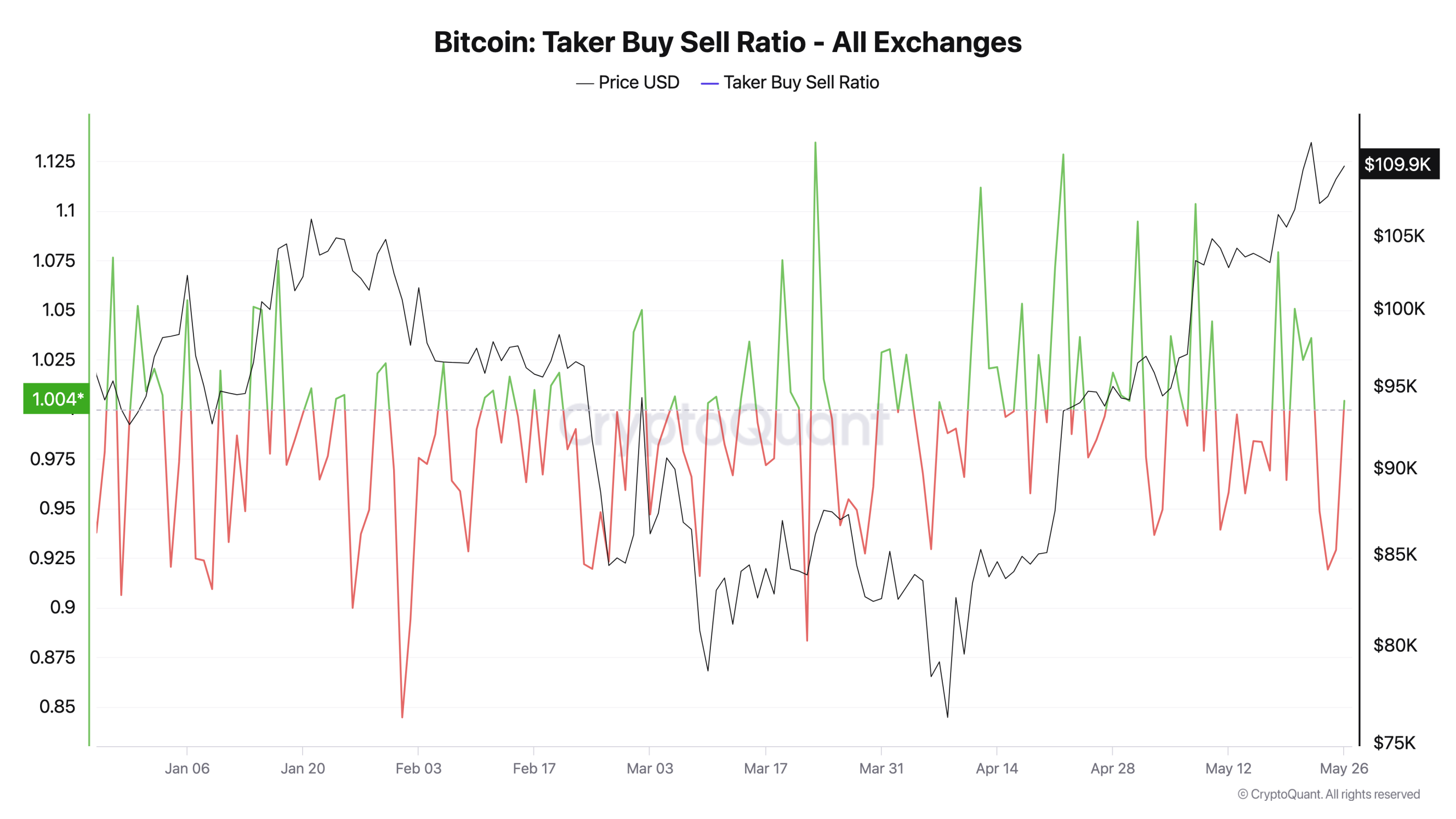

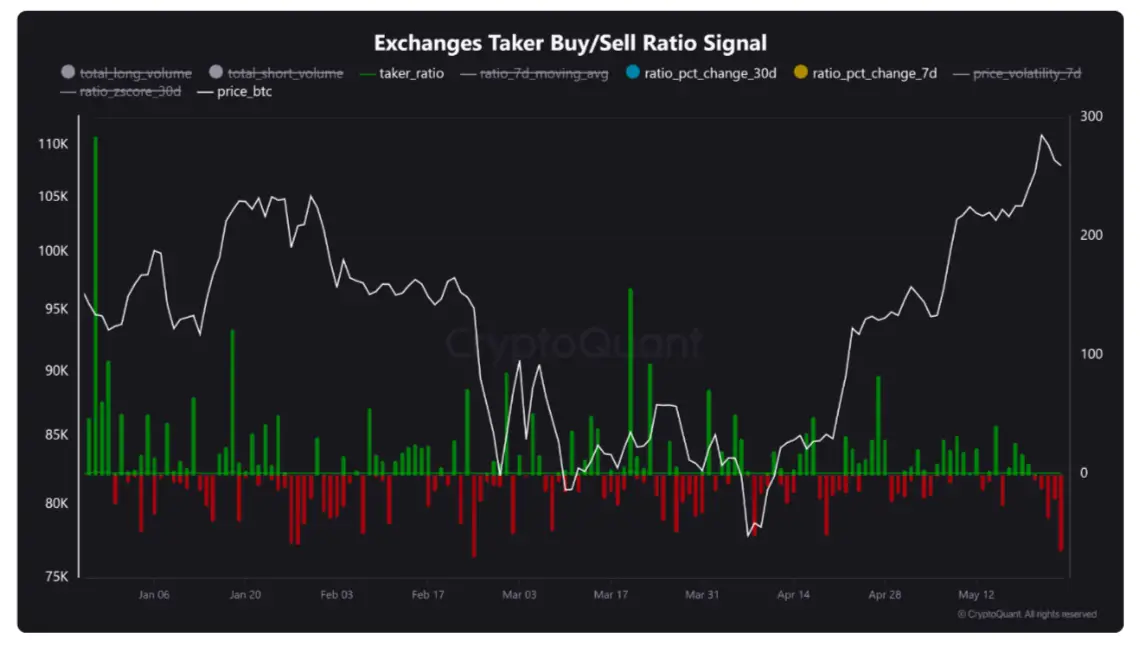

Although the course has developed positively, the movements on the stock exchanges do not give a clear answer. According to Cryptoquant’s data, the relationship between buyers and sellers fell on May 25th on 1, was corresponds to the level from the beginning of April.

This shows that there are more sellers than buyers, was again indicates the caution of the dealers. Most stock exchanges indicate a decline in purchase and sales activities, so that the market.

The volatility is skyrocketed and usually indicate one the change the general Market direction hin. If the bear momentum increasinglyBitcoin could move back down towards $ 105,000.

On the other hand the financing rates remain neutral, what is good, weil The market is not overflowed, as was the case before the last correction. This balance creates a situation in which a short squeeze is still possible if a sudden wave of buying pressure is created.

The decision about the next big Step for Bitcoin will depend on whether he the resistance and the economic problems defy can. Assuming that the Mood on the Normalized market, we can In the near future probably the course 155.000 Dollar see.

No Comments