Bitcoin-Cash Course exceeds $ 525-bets on a cut interestal reduction help the upward trend

- Bitcoin-Cash rose by 75% to $ 525, pushed by bet on a keygone reduction and strong technical signals that indicate further upward potential.

- The support at $ 478-508 and institutional purchases indicate that BCH can climb to $ 556.

Bitcoin-Cash (BCH) recently increased over $ 525 and has thus reached the highest price since December 18, 2024. This price jump corresponds to an increase of 75 % in the last 90 days and has made BCH one of the best performing cryptocurrencies in recent months.

The rally coincides with the growing market expectations that the Federal Reserve could make an interest rate reduction this month. This macroeconomic development has increased the optimism of investors, which, in addition to strong technical signals, indicates that Bitcoin Cash could record further profits in the near future.

The Bitcoin Cash rally was fueled by changing expectations regarding US money policy. Speculations about an interest rate reduction in the US Federal Reserve have increased liquidity and risk to risk, which encouraged dealers to accumulate assets such as BCH.

At the beginning of the year, Bitcoin Cash was traded below $ 300, but the positive mood has now been reversed. Around 83% of BCH owners are currently in profit, which reflects a wide interest. This is in contrast to the Bärisches environment of the past few months and illustrates a shift in market dynamics.

The increase to $ 525 broke through several resistors, which indicates strong upward dynamics. The market participants observe these developments closely to determine whether BCH can continue his recovery or face new challenges.

Support and resistance zones determine the course outlook

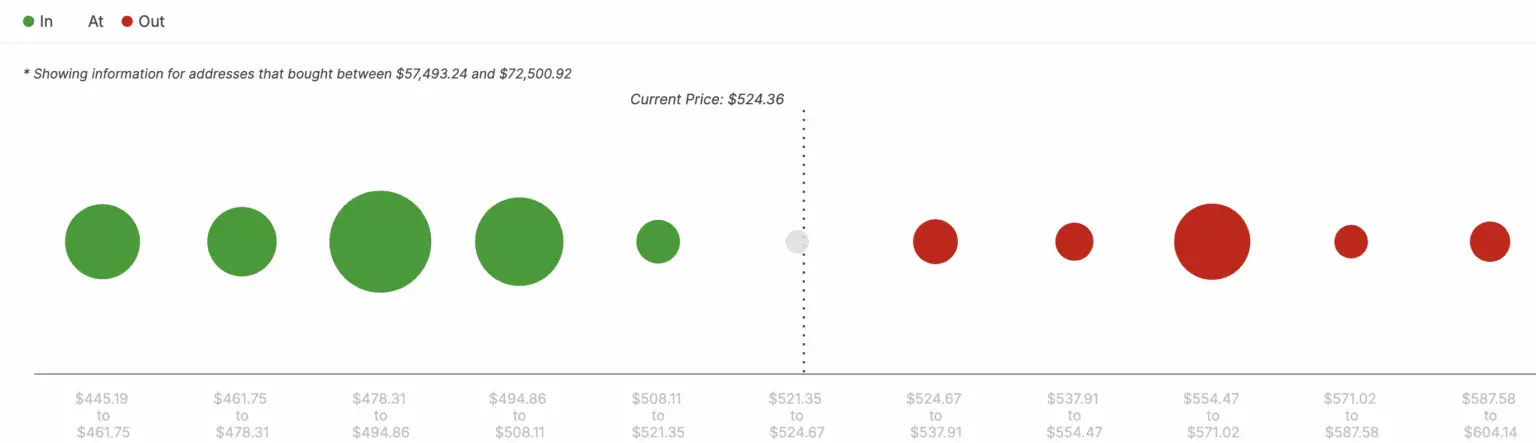

The on-chain data of Intotheblocks in/Out of the Money Around Price (Iomap) tool show important levels that influence the course events of Bitcoin Cash. A strong support zone is between $ 478.31 and $ 508.11, where many owners bch bought a profit before.

The resistance is higher, between $ 524.67 and $ 604.14, a region in which some owners have not realized losses. Since there are currently fewer holders in this zone, sales pressure could decrease so that BCH can break out over $ 525 and test higher levels.

On the daily chart, bch is traded within an ascending channel, which is characterized by higher maximum and lows. This formation signals a persistent upward trend. The relative strength index (RSI) is still below the overbought threshold values, which indicates that the upward trend could continue before it exhausted. In addition, the MACD (Moving Average Convergence Divergence) has shown an interest bully crossover that has been in last of April, which supports the positive price trend.

Indicators signal increasing buying pressure

The technical indicators indicate a continued question of investor. The Chaikin Money Flow (CMF) continues to be over zero, which indicates continuing purchase activity. The BBTREND indicator, which measures the trend strength based on the expansion of the Bollinger ligaments, shows growing green histogram beams in the last sessions, which indicates increasing upward moment and increasing volatility in the direction of the upward trend.

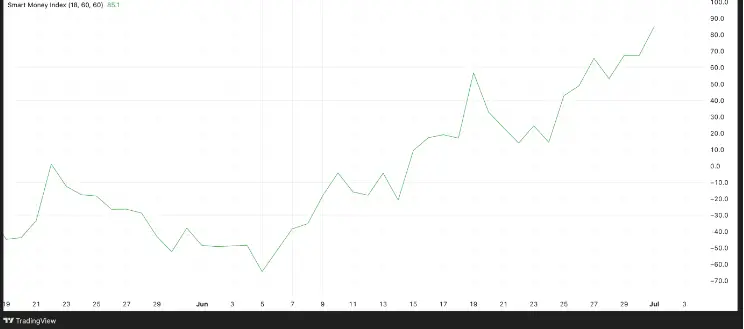

In addition, the Smart Money Index (SMI), which records the activity of institutional investors in the first and last trades, has increased by over 220 % since the beginning of June and is currently 85.1. This indicates an increased trust of experienced dealers, which is often a harbinger of continuing price increases.

If the current accumulation trend continues, Bitcoin Cash could push for $ 556.40 in the direction of the next resistance goal. Persistent purchase pressure and cheap macroeconomic conditions could support this increase.

However, if profit -taking or short -term sales occur, BCH could fall back in the direction of the strong level of support at $ 490.80. This would be more of a correction within the wider upward trend than a repentance.

No Comments