Bitcoin bulls are careful for $ 200,000 price target at the end of the year

- The Bitcoin indicators indicate a lot of trust, bergen but The risk of correction.

- The interest of institutional investors is growing, while private investors hold back.

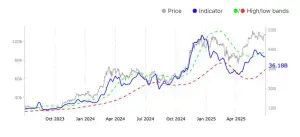

The BitcoIN course takes again drive on and surpasses the Estimates that he im next December $ 200,000 reached. The main reason for this is the increasing profitability of the Onchain indicators.

According to Glassnode is the percentage that increased from 90.8 % to 96.7 %, so that Almost every Bitcoin holder has a positive balance. Normally triggers this situation sales pressure, Since the most others besides the long -term investors want to take their profits with them.

The relationship between unrealized profits and losses (net unrealized profit/loss ratio) rose from 5.3 % to 7.9 %, which means that the majority of dealers have massive book profits. The relationship between realized profits and losses rose from 1.1 to 2.8 and reached a new high.

This shows that the profits realized are now significantly higher than the losses – a positive sign, but this is usually shortly before Market reversations appearance.

Despite the optimistic mood, these tips are also potential tilt points, according to which further upward dynamics are problematic without new demand.

Cryptocon describedThe positioning and patience tests that Bitcoin spent almost 195 days in a sideways movement in this cycle, which was described as a grueling market phase.

This is day 195 of sideways Bitcoin price action since December 18th of last year.

The trend has been simple, but gruesome:

All of the great price action has been made in very short bursts, totaling just 36 days. We have now spent a total of 2 years in sideways price action.… pic.twitter.com/1dbrYRdf6T

— CryptoCon (@CryptoCon_) June 30, 2025

Bitcoin Spot CVD jumps 76% because the sellers withdraw

The market activity remains generally steamed , in particular in the spot and derivative segment. The CVD (Cumulative Volume Delta) of 76.4% shows that aggressive sellers withdraw.

The open interest on futures went back slightly to $ 36.2 billion. The CVD for perpetual futures, on the other hand, fluctuated strongly. This shows that foreign -financed dealers tacitly switch their positions to make profits.

Institutional inflows remain stable – private investors are still hesitating

The traditional financial sector remains active. The net inflows in Bitcoin-Spot ETFs doubled almost to $ 1.9 billion. The ETF trade volume also rose to $ 15.5 billion, while the MVRV ratio rose to 2.3. This indicates thisthat institutional investors Your winningsholdbut are still active.

The metrics of the retail chain show continuing activity. The transfer volume rose by 32.6 % to USD 9.2 billionwhereby the network fees rose due to moderate demand. However, the number of active addresses went back slightly what showsthat the private investors still reservedare.

Die realized Change of capital Slering slightly what on one Slowdown indicates the inflow of new capital. The relationship between STH and LTH-offer rose to 15.5 %, What an increasing Tendency to participate in short -term owners with persistent dominance Long -term ownershows.

How Stockmoney Lizards foundBitcoin could soon break out of his multi -year cycle and the Away for a potential increase to $ 140,000 and on on Free $ 200,000 at the end of the year.

This formation is not an ascending wedge.

Bitcoin is about to break out of a multi-year channel.

The next leg will be explosive.

Intermediate target: 140k.

Year-end target: 200k. pic.twitter.com/NkftUJUGeh— Stockmoney Lizards (@StockmoneyL) June 30, 2025

No Comments