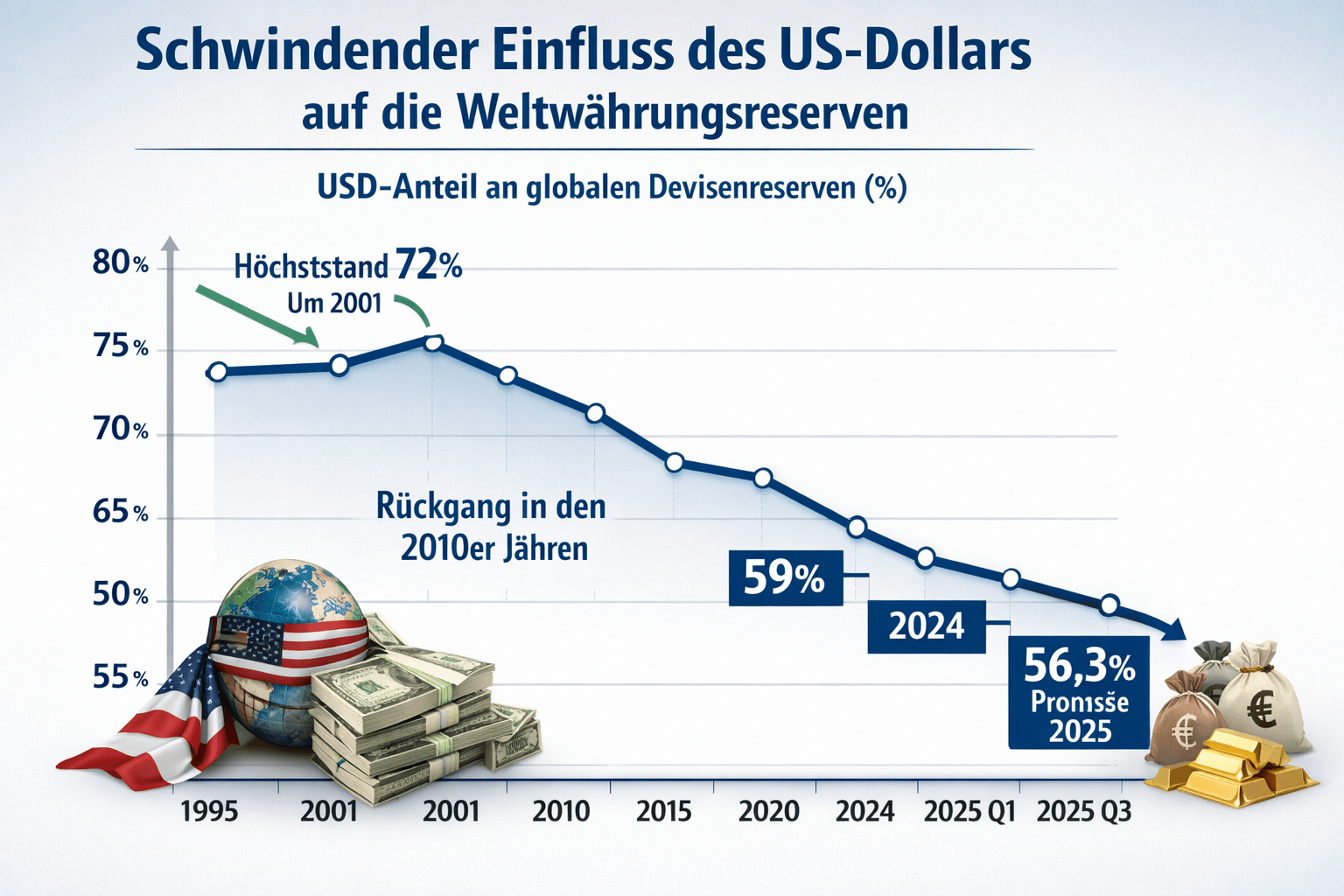

Bitcoin benefits from dwindling dollar influence – new IMF data shows long-term trend

- New IMF data on world currency reserves show: The dollar is losing influence because central banks are diversifying their holdings more widely.

- For the crypto industry, this means a financial system that is becoming more multipolar because Bitcoin and stablecoins are becoming more important.

Die publication of the International Monetary Fund (IMF). Currency composition of official foreign exchange reserves (COFER) at the end of 2025 shows continuous long-term trends. The share of the US dollar in world currency reserves is falling. At the same time, they especially win Euro and the Chinese renminbi and even currencies of smaller industrialized countries are becoming more important.

The data shows a slow but clearly visible diversification of central banks, so far without any abrupt shifts. This has several indirect but relevant implications for the crypto industry.

Less dollar influence strengthens Bitcoin

For the crypto industry, the decline in the dollar share is an indication of a long-term decline in trust in the traditional reserve currency. Bitcoin is increasingly being used as a seen as a “neutral alternative, not influenced by state interests” and can therefore continue to rise in price in the long term.

The broader reserve distribution highlights the geopolitical fragmentation of the global financial system. An environment in which no single currency dominates is considered favorable for non-state-controlled digital assetsas these are not tied to national interests.

Stablecoins are becoming more relevant

Although COFER data only captures government reserves, the trend has an indirect impact on the stablecoin discourse: While the dollar loses weight in official reserves, its weight increases digital use via USD stablecoins in international trade. This creates an area of tension between government reserve policy and private sector dollar representations.

The IMF report contains no direct statement about cryptocurrencies. The importance for the industry still arises from the Interpretation of the macro data Analysts and institutional investors.

Can Bitcoin win in the long term?

The new IMF-COFER data confirm the long-term trend Diversification of global currency reserves. This means for the crypto industry: More tailwind for Bitcoin, more geopolitical relevance for stablecoins, and an environment in which non-governmental digital assets look more attractive.

No Comments