- Little liquidity, altcoin weakness and the wait for November economic data are causing restraint.

- Alone ETH remained relatively strong, while Bitcoin dragged the other altcoins down.

In the early morning On Sunday morning US Eastern Time, the BTC price slipped back below the $90,000 mark. Investors are showing little courage to take risks because everything is waiting for the statements from the central banks of the most important industrialized countries this week.

Bitcoin was trading at around $89,600, down about 0.9% from the previous day, month-on-monthand der Verlust 7,6 %.

Ethereum is the only altcoin with a plus over the week

ETH initially stood at $3,126.94 but then fell to $3,104, marking an intraday decline but a rise of more than 2% over the course of the week means. Ethereum was the only altcoin that Bitcoin was unable to pull down, and instead even rose slightly.

Otherwise the price development was negative. SOL, XRP, DOGE and ADA lost double digits compared to the last month. There is no end in sight to the general altcoin weakness.

At the time of writing, the market capitalization of the entire crypto market is almost $3.15 trillion. Trading volume in the last 24 hours was around $89 billion, down about 0.8% from the previous day. However, this may have been due to the usually low liquidity on Sundays.

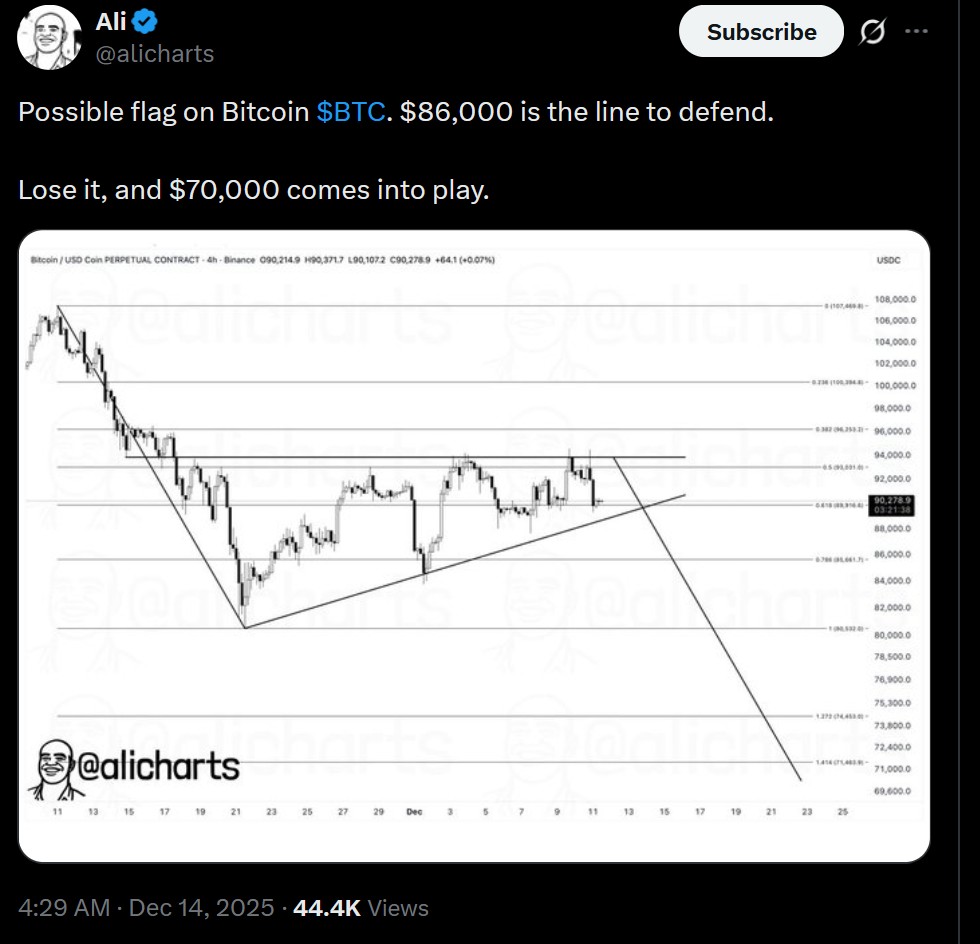

However, some analysts are pessimistic and see the price of Bitcoin falling to $86,000. Expert Ali Martinez posted on Sunday at X, $86,000 remains a crucial level for Bitcoin to hold. He noted that if this support does not hold, it could go much further down.

Waiting for the new economic data

The coming days will be filled with events that will not only shape the crypto industry in the next few weeks, as the new economic data will be announced in the USA:

- Unemployment rate

- Employment data

- Number of new applications for unemployment benefits

- Inflation data for November

- Purchasing Managers Index

The latter is an indicator of the basic mood in the manufacturing industry. We are also awaiting with interest the speeches by US Federal Reserve Governors Christopher Waller and Stephen Miran, from which conclusions will be drawn about further interest rate developments.

| Datum | Indicator | Importance for markets |

|---|---|---|

| 16. Dez 2025 | Unemployment rate + employment figures (Nov) | Major influence on risk assets & interest rate dynamics |

| 18. Dez 2025 | CPI Inflation Rate (Nov) | Central to Fed policy and market volatility |

| 18. Dez 2025 | Initial unemployment claims (weekly) | Leading indicator for labor market trends |

| ~19. Dez 2025 | Purchasing Managers Index (PMI) | Leading indicator of economic activity |

Japan expects higher interest rates

Analysts are eagerly awaiting developments on the other side of the globe in Japan, where the BOJ (Bank of Japan) is expected to raise interest rates at its upcoming meeting on Thursday. BOJ Governor Kazuo Ueda had made it clear that inflation has been above the central bank’s two percent target for over three years.

The news agency Reuters According to this, the markets have already largely priced in a 0.75% increase in the key yen interest rate.

No Comments