- US inflation data triggered a Bitcoin rally to almost $89,500, followed by a quick pullback and rebound.

- Dealer gamma, the ETF cost base around $83,800 and sales from long-term holders will be key factors for the next few days.

The Bitcoin price has been on another wild rollercoaster ride in the past 24 hours. After surprisingly positive inflation data was released in the US yesterday afternoon, BTC initially rallied to $89,477, only to fall to $84,481 within four hours (-4.5%).

However, what followed was just as surprising: at the time of writing, BTC recorded four green 4-hour candles in a row and was able to recover to $88,165.

These are the experts’ assessments of what matters now.

Inflation data creates a roller coaster ride for Bitcoin

The US inflation rate (YoY) was reported at 2.7% for November – lower than the previous month (3.0%) and at the same time below expectations of 3.1%. Core inflation was also expected at 3.0% but actually fell to 2.6%.

The stopped measuring everything, that’s why

pic.twitter.com/PsFPKXUJuS

— Financelot (@FinanceLancelot) December 18, 2025

The subsequent Bitcoin sell-off may also have been encouraged by the fact that many market observers publicly questioned the reliability of the CPI calculation due to data collection gaps and estimates caused by the shutdown, which quickly dampened the initial euphoria.

CryptoQuant analyst Axel Adler Jr. ranked the inflation rates via X as follows: “This is not a consistently bullish signal. It is positive for risk assets, but not enough to clear all risk-off warning flags. At its core, it is support, not a trigger.”

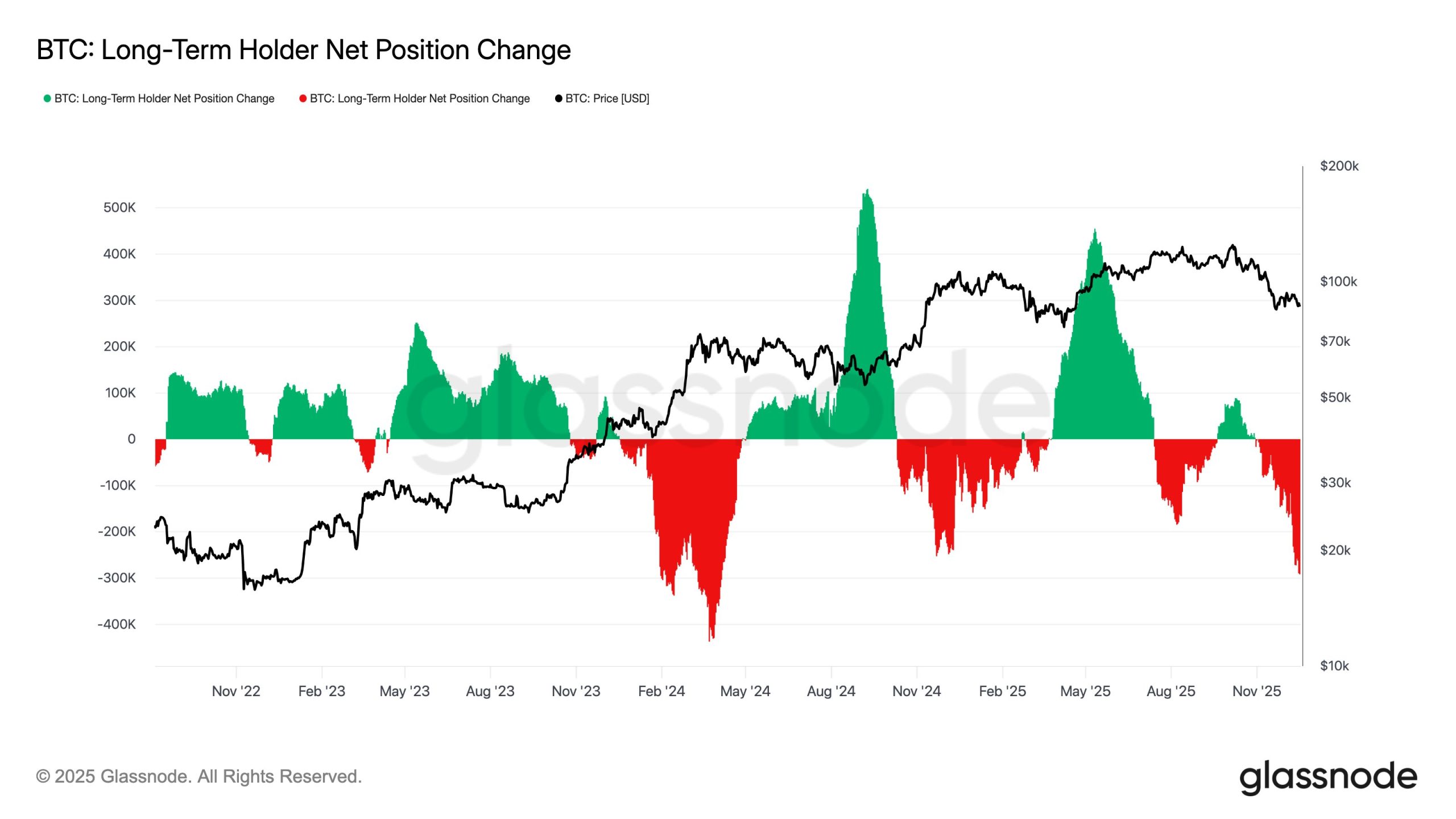

Meanwhile, supply-demand dynamics in the Bitcoin market appear to continue to be the driving force. Glassnode Researcher Chris Beamish writes about the supply pressure from long-term holders via X:

“Long-term BTC holders continue to sell and increase their sales, sustainably increasing supply in the market.”

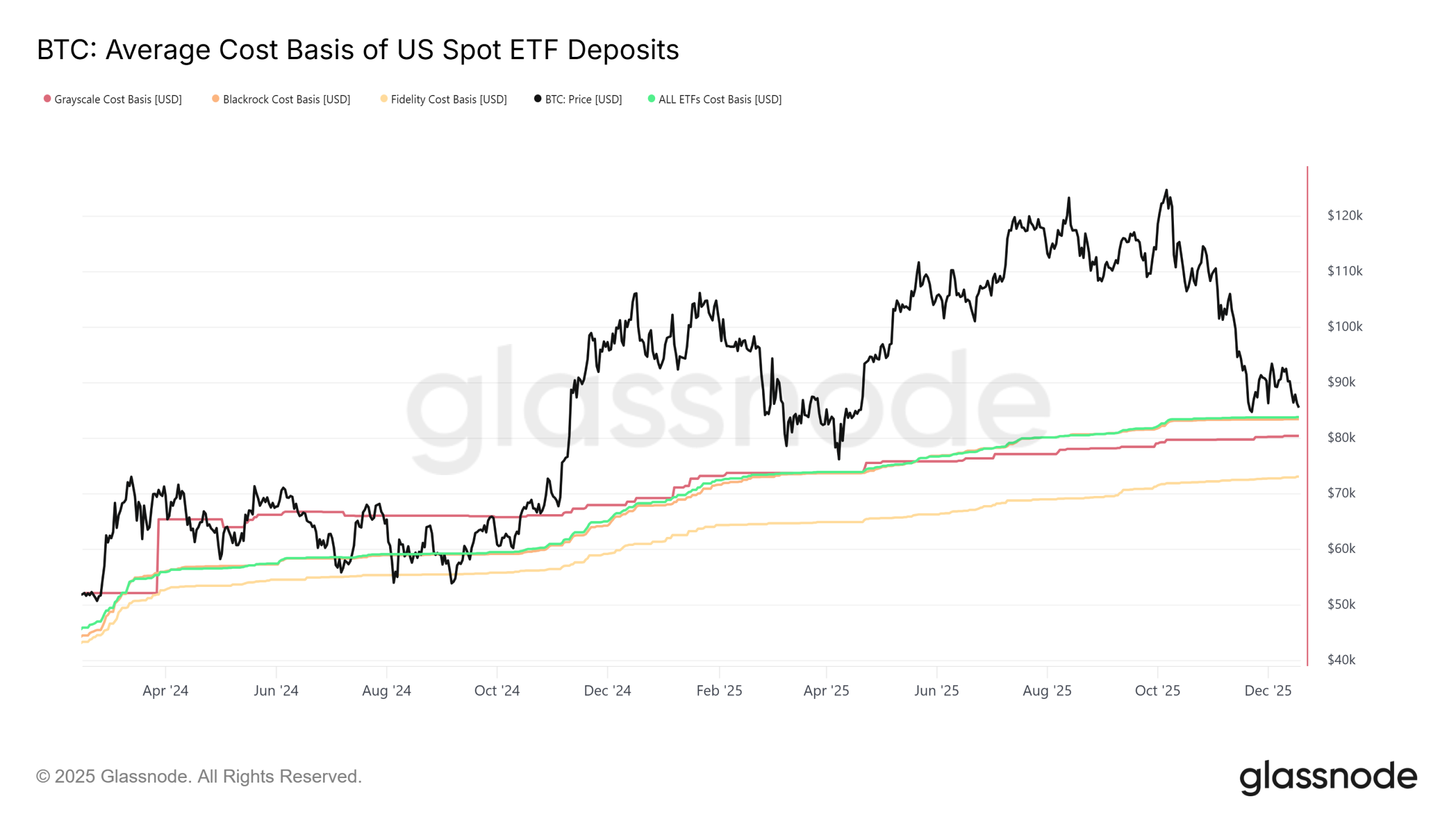

At the same time, Beamish sets a clear price that should definitely be defended by the bulls: “US spot Bitcoin ETFs now hold an average cost base near $83,800, with BlackRock and Fidelity slightly below. It will be interesting to see whether this cost base is defended.”

What’s next for Bitcoin?

CryptoQuant Analyst Markunn refers Meanwhile, on a recurring pattern that is relevant for today’s trading day: “Fridays have not been kind to Bitcoin recently. The most recent Friday price action was consistently rather bearish.” As the chart below shows, the Bitcoin price fell on each of the last five Fridays.

David Eng provides a medium-term roadmap via X. Seine These: By December 26th, a large portion of the gamma structure will be mined in Bitcoin’s options market. We are facing a “double” liquidity event that will wipe out 67% of all derivatives trading by December 26th.

“Tomorrow, $128 million worth of gamma contracts expire (21% of the total), removing the immediate drag that keeps us below $90,000,” writes Eng, who further argues: “Watch the $90,616 flip level. If we cross that level, the intraday shackles fall away.”

But the even more important day will be next Friday, December 26th. $287 million in Gamma expires next week. “An incredible 46.2% of all traders’ gamma exposures occur in this one day,” said Eng.

Why this is important? According to Eng, the dynamics of the options market are more important than the focus on the US spot ETF market. “Trader gamma forces are currently about 13 times stronger than ETF flows,” Eng points out. “Traders ~$507.6M vs. ETF ~$38M. This is why the market follows technical gamma levels ($85,000/$90,000) and ignores ETF volume.”

Dealer Gamma forces are currently ~13x stronger than ETF Flows

Dealer ~$507.6M

ETF ~$38MThis is why the market is obeying the technical gamma levels ($85k/$90k) and ignoring the ETF volume.

— David

(@david_eng_mba) December 18, 2025

No Comments