Baby boomers discover the Bitcoin market – and have $ 79 trillion with them

- Baby boomers have a fortune of 79 trillion dollars slowly push into the Bitcoin markets, which changes the trends in crypto investments.

- Financially experienced boomers are driving high-quality crypto investments-despite widespread skepticism and concerns about fraud.

Baby boomers who were born between 1946 and 1964 have Sea the US Federal Reserve of around $ 79 trillion. Although they have been skeptical about cryptocurrencies for a long time, this population group begins to influence the Bitcoin markets more and more.

A Message From Coinspot shows that the boomers are the fastest growing age group in cryptocurrency, with the number of investors doubled within one year. Although only 4.4 % of investors are over 60 years old, the capital volume that they dispose gives them an overwhelming influence.

Rod Tasker, a former Anz-banker and baby boomer, said that older investors usually have a high degree of financial education and already have extensive portfolios. An noticed:

“Even if the number of investors is relatively low, the amount of money invested is probably higher than with other population groups.”

He added that these investors often include real estate, stocks and even options in their portfolios and make Bitcoin more of a strategic expansion than a speculative gambling.

However, the same age group is often addressed by crypto fraudsters. Tasker emphasized that many boomers grew up in a trusting, less networked world, which makes them more vulnerable. He said that factors such as dementia and lack of technical awareness increase the risk.

In one case it was about an 80-year-old former mortgage broker, Mike, who was the victim of a Bitcoin fraud after a Deepfake-Video of the Australian Prime Minister Anthony Albanese, in which he campaigned for a fake investment platform. He was persuaded to transfer a few hundred euros before he was pushed to invest 10,000 euros. After trying to redeem her Bitcoin, his skepticism grew $ 400,000.

Skepticism, caution and gradual acceptance

Die Coinspot survey From April 2024 shows that the acceptance of cryptocurrencies among Australians at the age of 60 is still low, since only 6.2 % of the owners of self -governing pension funds invest in cryptocurrencies. For those who do not manage their funds themselves, this proportion drops to 3.2 %. Nevertheless, 38.5 % of the older Australians stated that they were open to future crypto investments-this corresponds almost to the national average of 37.8 %.

Tim Wilks, Chief Business Development Officer from Coinspot, said that the acceptance curve is steep with older investors, but both interest and participation grow. He found that this population group begins to consider crypto as part of their retirement strategies.

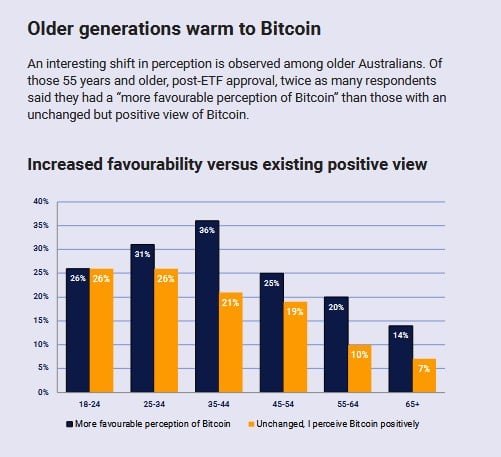

Another Australian stock exchange, independent reserve, reportedthat crypto systems among investors aged 65 have tripled since 2019. In the group of 55- to 64-year-olds, possession doubled to 16%. However, 52.4% of the over 65-year-olds either remain neutral or believe that crypto is fraud.

In the United States, the data from Blockchain Statistics and Demandsage show that boomers make up 10 % of crypto owners. In the United Kingdom, the Wealth Report of EY stated that 15 % of boomers are striving for diversification in alternative assets such as Bitcoin. The shift seems to be more pronounced in wealthier, financially formed persons.

Simon B., a 57-year-old former IT specialist from the Sunshine Coast, has created his entire pension fund in cryptocurrencies. As a member of the asset consulting service Collective Shift, he acted actively, but switched to long -term investments after a big loss.

He said that older members tend to prefer large -scale systems such as Bitcoin, Ethereum and Solana and keep themselves away from Memecoins. A new member of the group is 78 years old.

Simon believes that the legitimacy of ETFs and the support of the government have contributed to changing perception. “As soon as a asset has reached a trillion dollar, it must be taken seriously,” he said. However, he estimates that only about 3-5% of Boomer Bitcoin currently sees as a useful investment.

Conceptual barriers and the role of education

A great psychological barrier for Boomer is the abstract nature of digital assets. Mike, the fraud victim, said his generation preferred to have something tangible. “When I buy a company’s share, I have the stock certificate. So I know that I have something real, ”he said. He added that the older generations due to their life experience and deeply rooted conviction that“ if something sounds so fantastic, it is probably not ”are careful

James Moore, for the The Independent wrotedescribed this generation difference as a shift in the values. He noted that behind Bitcoin there is more of an idea than a physical unit, which is more accepted by younger investors.

Wealthy investors are increasingly turning to education and strategy. The former National Australia Bank and Westpac-Banker Ken Standfield, now 60, started a crypto training platform called Cryptotradingks in 2021. His community includes working people and pensioners aged up to 89. Many of them are active dealers who use technical indicators and volatility signals and often move amounts of $ 10,000 to $ 100,000. Standfield said that older dealers focus on maintaining capital:

“I classify myself as an older dealer because I cannot lose my capital.

Despite their caution, the trade also offers intellectual stimulation and commitment. Standfield:

“I will never and never get calm. It doesn’t matter how old I am. I could be 99, I will still do something.”

One Opinion poll The Devere Group among 700 baby boomer customers worldwide existed. It showed that 45% of the wealthy boomers now prefer Bitcoin compared to traditional secure systems such as gold. CEO Nigel Green attributed this to the participation of institutions, Bitcoin ETFs and clearer regulation in important markets.

To the extent that digital assets gain institutional support and regulatory clarity, wealthier boomers are slowly becoming a central force on the cryptoma markets. With $ 79 trillion that are available to them, even marginal mood swings could have a major impact on Bitcoin acceptance and market dynamics.

No Comments