AVAX: Retail throws the towel but Smart Money holds through – course increases

- Smart-Money Wallets keep stoically, despite 375% profit-there seems to be more in there

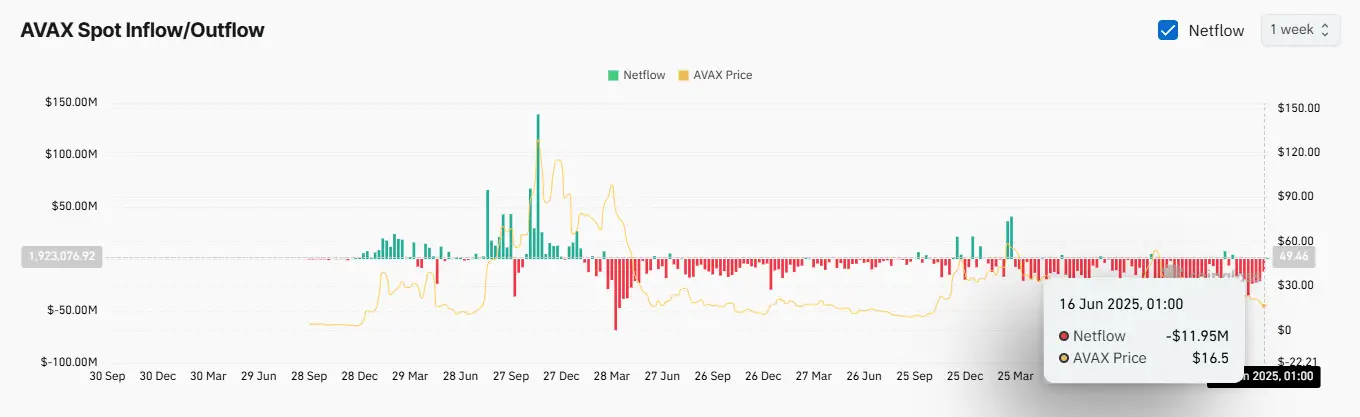

- Retail has repelled $ 821K within 24 hours of bought $ 11.9m in the last week, and has thus become completely bearish

Avalanche (Avax) recorded its first green candle in a month and rose by 2.62% within 24 hours, which ended a break -in of 26.22%. This movement attracted attention back to the token, especially since Kluge continues to keep investors and resist the temptation to take profits with them.

These investors, who often get in early and get out in good time, are currently sitting on considerable profits. Nansen’s data show that you have made a profit of up to 375 % with your AVAX positions. In total, eleven observed Wallets almost a million dollars of not realized profits. Despite these high returns, no one has sold their positions, which indicates that one believes in another upward trend.

While Smart Money is firmly in the saddle, the picture with private investors looks very different. Coing reportedthat the retailers have switched to profit. A week ago, they raised their positions and bought Avax worth $ 11.9 million. Now they have changed direction and rejected token worth $ 821,000 within the last 24 hours.

Derivatives are bearing because the retail trade is betting against Avax

Retailers on the derivative markets follow a similar trend and show doubts about the short -term strength of avalanches. The Open Interest Weighted Funding Rate, a mood indicator in the futures trade, fell to -0.0022%. This shift to the negative area means that more traders bet on a decline than on an increase.

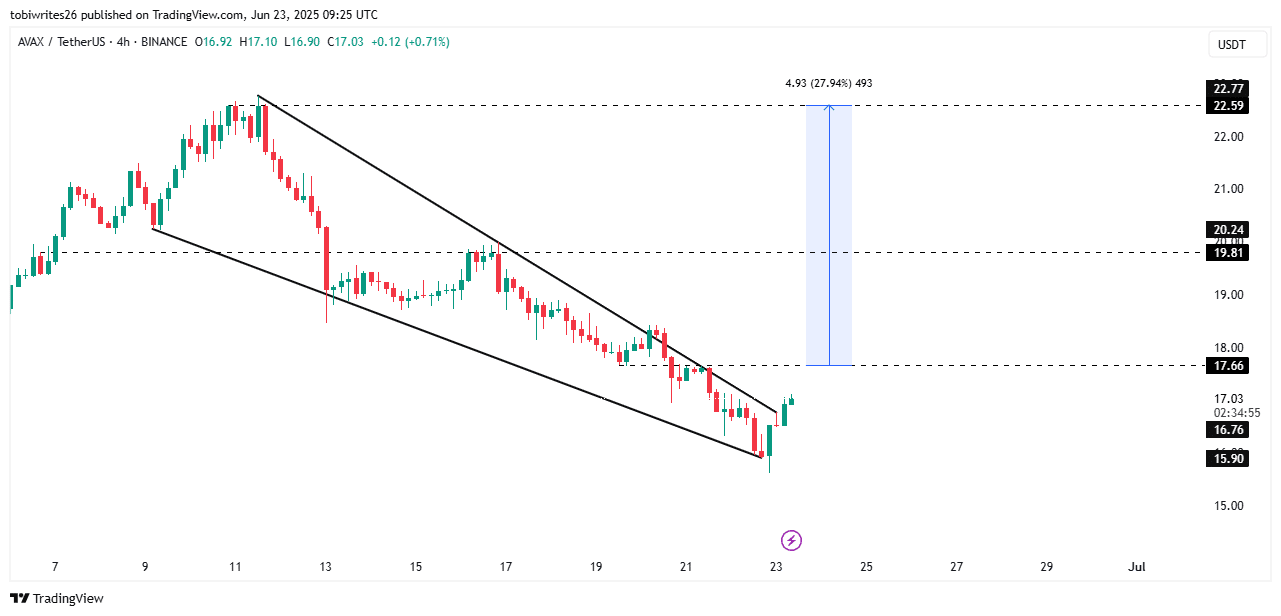

At the same time, the technical indicators showed a shimmer of strength. Avax broke out of its descending channel pattern – a movement that often shows a change of direction. In theory, this could drive the courses back towards the upper end of the channel and enable profits of about 27 % from the outbreak level. However, this path will not be easy. The next big resistance is $ 19.81, and it will be crucial to overcome it before an attempt is made to reach the $ 22 mark.

Even with this short -term recovery, the underlying numbers warn for caution. The Total Value Locked (TVL) in the Avalanche ecosystem has not changed in the past few days. This lack of new capital, which either flows or drains out, shows how careful the wider market is still.

Unclear direction

Despite the price increase, the market mood is anything but uniform. On the one hand, the large investors stick to the stock and seem to put on the fact that the current increase offers even more space for growth. On the other hand, the broader retail segment takes profits and opens empty sales positions, as it doubts that avalanches can stay above the key.

Since there are no strong tributaries in TVL and the resistance levels move closer, the further path depends heavily on whether Smart Money continues to resist the urge to sell. If you survive the current headwind, this could offer the token at least at short notice.

No Comments