Aptos overtakes Stellar at the RWA-TVL and now takes third place behind ETH and ZK

- Aptos increases by 55% and outdated Stellar in the RWA TV to take third place behind Ethereum and ZKSync when introducing TokenZed Assets.

- The RWA market reaches USD 24.52 billion, as newer blockchain gains the ground and a change of legacy networks to scalable L1 systems takes place.

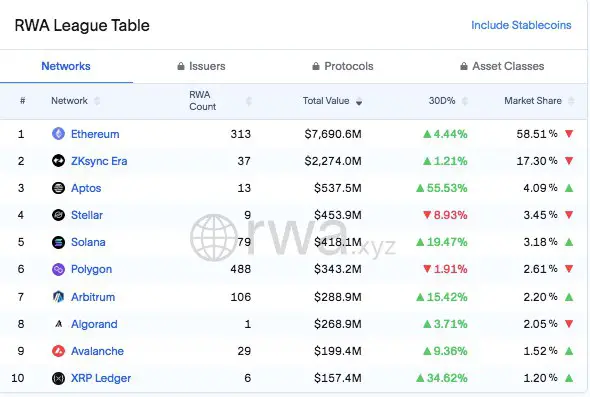

Aptos has a great increase in the acceptance of Real-World assets (RWA) record And climbed to third place under the blockchain networks in relation to the total value (TVL). Last month, the Layer 1 network recorded an increase of 55.53 % in the tokenized RWA stocks and thus overtook Stellar, which recorded a decline in the same period. The data of RWA.xyz show that aptos now holds $ 537.5 million of tokenized real-world assets, which means that it is only behind Ethereum and ZKSync.

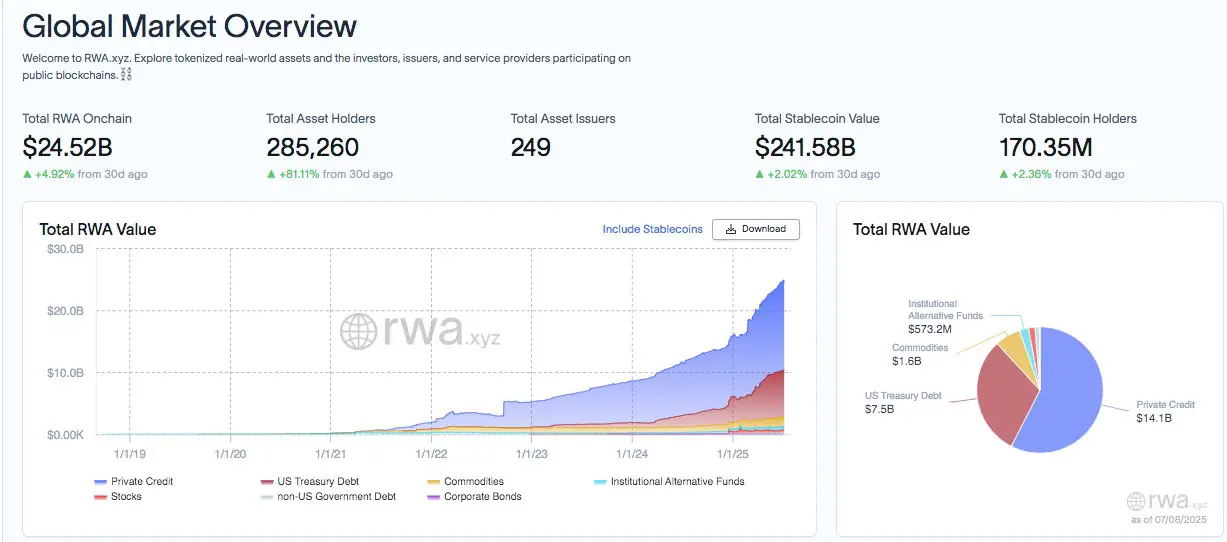

The shift takes place in the middle of an increasing dynamic in the entire RWA sector, whose total onchain value increase to $ 24.52 billion by July 8. The broader increase in tokenized assets indicates an increasing interest of institutions and developers, since recent blockchains such as aptos have gained in traction compared to long -established networks.

Lead Ethereum and ZKSync while aptos gains ground

Ethereum remains the dominant network for tokenized real-world assets with a value of $ 7.69 billion or $ 58.51 % of the entire RWA market. ZKSync follows with $ 2.27 billion, which corresponds to 17.30 % of the market. Aptos has emerged with a market share of 4.09 % as a strong third party and exceeds Stellar with $ 453.9 million.

This month, Stellar recorded a decline in TVL by 8.93 %, which continues the trend of a lower tokenization activity in the old networks. Meanwhile, Solana and Arbitrum also had a positive dynamic with an increase of 19.47 % and 15.42 %. Other platforms with remarkable changes are avalanches that rose by 9.36 %, and XRP Ledger, which rose by 34.62 % in the same period.

Despite this growth, polygon, which is leading the number of RWA emitters with 488, suffered a decline in its RWA value by 1.91 % to $ 343.2 million. Algorand and Avalanche completed the top 10 with $ 268.9 million or $ 199.4 million to TVL.

Apart from the individual networks, the entire RWA market grows at a steady pace. The total value of the RWA concluded across all chains rose by 4.92 % in the month comparison, while the number of RWA holders in the individual chains increased by 81.11 % to 285,260. Private loans with a value of $ 14.1 billion are still the dominant category, followed by US state bonds with USD 7.5 billion. Raw materials and institutional funds follow $ 1.6 billion or $ 573.2 million.

In July, 249 issuers were actively involved in the tokenization of assets on public blockchains, which reflects a diversification of the products brought into onchain financing. The increase in issuance indicates constant growth of institutional participation in this sector.

New network preferences signal change in the RWA management

The quick growth of aptos underlines a wider trend towards the introduction of scalable layer 1 networks for tokenized financing. The performance gap between newer and older networks is reduced, and the developers show an increasing willingness to build RWA infrastructures on chains that are optimized for speed and low costs.

At a time, the realignment takes place when traditional financial products are increasingly moved to Onchain. The market dynamics indicate that the clarity of the regulations and access to the systems of the Federal Reserve could further promote acceptance, especially for assets such as RLUSD and other stable instruments.

No Comments