- The Paris-based asset manager Amundi, part of Crédit Agricole, has launched a tokenized version of its euro money market fund on Ethereum.

- The Ethereum version combines a private distributed ledger with a public blockchain. This combines regulatory security with the interoperability of open networks.

Amundi has completed its entry into the onchain representation of fund shares with the tokenized “Amundi Funds Cash EUR”. The structure is based on a two-stage model. It combines a private Distributed-Ledger-infrastructure of the CACEIS-Bank as a depository with public availability Ethereum.

The CACEIS banking group, which is also part of Crédit Agricole, offers asset servicing for asset managers, insurance companies, pension funds, banks, private equity and real estate funds, brokers and other business customers.

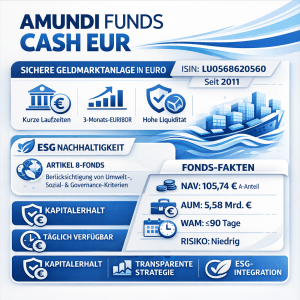

The underlying fund has a volume of around five billion euros, and sales continue to take place in parallel via traditional channels.

According to official notice Amundi is pursuing an approach that combines the regulatory requirements of institutional fund products with the technical interoperability of public networks. The Tokenization accelerates the settlement process, increases the transparency of the register and integrates other digital assets – in particular Stablecoins – into institutional workflows.

Money market funds as an entry into the RWA world

According to Amundi, money market funds are the most suitable asset class for the new fund duality, as they can be relatively easily converted into a real-world asset structure due to their standardization, liquidity and low volatility.

Amundi also sees enough potential in tokenization for more efficient liquidity management and more precise intraday processing.

With this move, Amundi is moving into a growing market segment in which several large US asset managers are either testing or already using blockchain-based fund shares.

The expansion to other asset classes could take place, but according to the company, this depends on the design of the regulatory framework and the market acceptance of digital settlement models.

Jean-Jacques Barbéris, Amundi division manager for institutional and corporate clientscomments on the background of the new hybrid fund:

“The tokenization of assets is a change that will accelerate worldwide in the coming years. This first initiative for a money market fund demonstrates our know-how and the robustness of our methodology in covering concrete use cases. Ensuring the highest security standards, Amundi will continue and expand its tokenization initiatives for the benefit of its customers in France and internationally.”

Two-pronged for a broader customer base

Jean-Pierre Michalowski, Chief Executive Officer bei CACEISexplained the custody service adapted to the hybrid fund:

“With the new hybrid transfer agent service, our customers can quickly and easily benefit from a new distribution channel via blockchain to their investors. This is a crucial step towards our goal of offering 24/7 subscription and redemption services for mutual fund shares denominated in stablecoins or one digital central bank currency are payable as soon as they become available.”

No Comments