- Cardano bets have reached a monthly high because dealers expect an outbreak of $ 0.77.

- However, the increasing resuscitation of sleeper wallets can generate so much sales pressure that recovery of ADA slows down towards $ 0.83.

Cardano (ADA) was traded at around $ 0.7222 at the time of going to press, after it was loud this week Coingecko data Had lost 1.36 % . The cryptocurrency tried to break through $ 0.77 on Wednesday of its 50-day EMA (exponential moving average), but met with resistance, which led to a decrease of 5.32%.

At the current level, Ada stays at $ 0.74 over an important resistance zone. A successful outbreak over this level and a daily closing course over $ 0.77 could drive the price up. Analysts assume that if it maintains this dynamic, ADA could increase by a further 13% to test the next resistance at $ 0.83.

Dealer lerhöhen the long positions- A positive mood increases

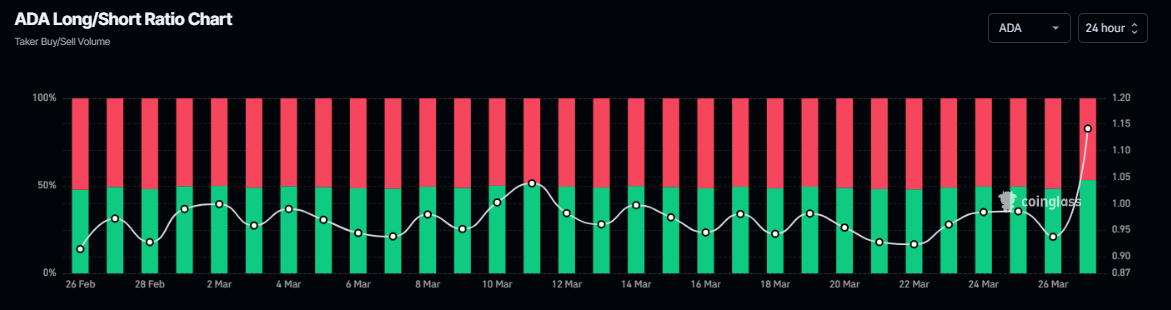

Onchain data indicate growing optimism among the dealers. According to the Coinglass, the ratio of long-to-short positions at Cardano has reached 1.15, the highest level in one month. A ratio of one ratio indicates that more traders bet on an increase in the ADA course.

Quelle: Coinglass

Another positive factor is the rising stable coin market capitalization Cardanowhich achieved a record of $ 30.77 million on Monday, based on Defillama’s data. An increase in stablecoin activity in the Cardano network often signals a higher demand for decentralized financial applications (DEFI).

The technical prospects of Cardano indicate a possible upward movement when important levels of resistance are broken. The relative strength index (RSI) is 49 and moves to the neutral value of 50, which indicates a reduction in downward pressure. If the RSI exceeds the value of 50, this could confirm a persistent interest bully tendency.

Quelle: TradingView

The MacD indicator (Moving Average Convergence Divergence) also showed an interest bullish crossover on Tuesday, which signals a possible upward trend. If the buyers maintain the pressure, Ada could build on his latest profit and try an outbreak of $ 0.77.

Ranimized sleeper wallets can press profits

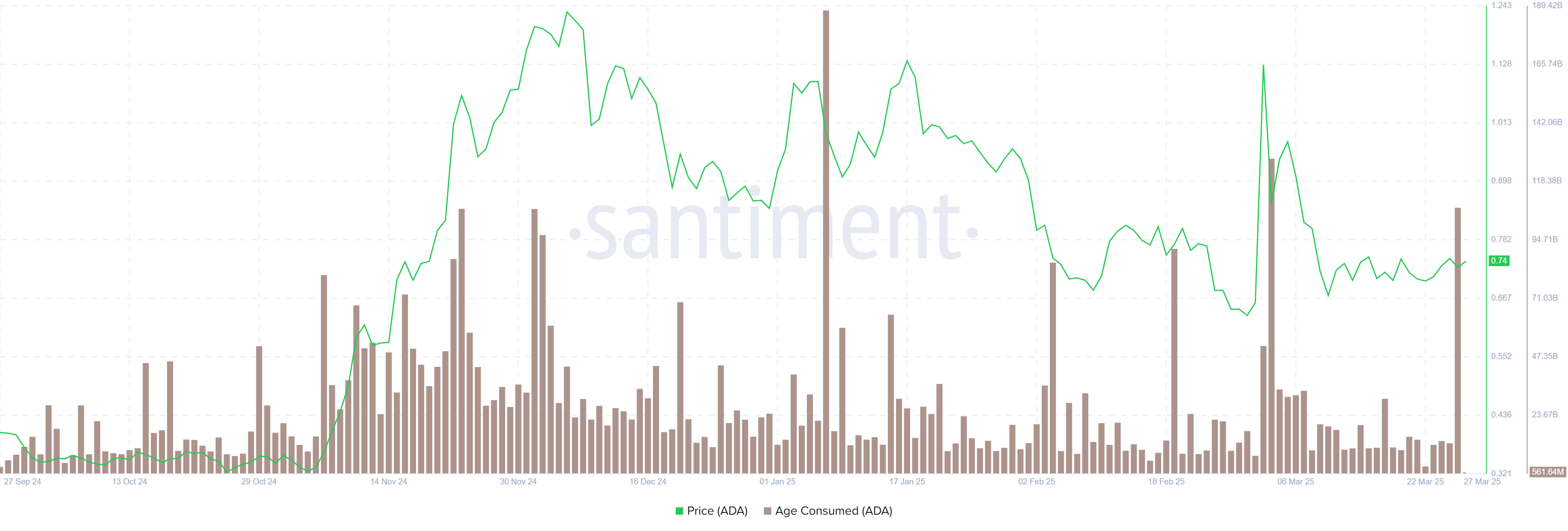

Although positive key figures indicate further growth, retailers should remain careful. Santiment’s data show an increase in Cardano in the metric “Age Consumed”, which follows the movement of previously inactive wallets. Increased activity of formerly inactive wallets could lead to additional sales pressure, which could slow down the upward trend from ADA.

What: Santiment

According to a CNF – forecast for Cardano consolidated ADA within a symmetrical triangle pattern. This formation is often preceded by a significant price movement, and retailers observe exactly whether ADA will break out in the upcoming meetings.

In view of the increasing betting on increasing course and the improving technical indicators, Cardano course development remains a topic for dealers, since they want to assess whether ADA can maintain their momentum and move towards new highs.

No Comments