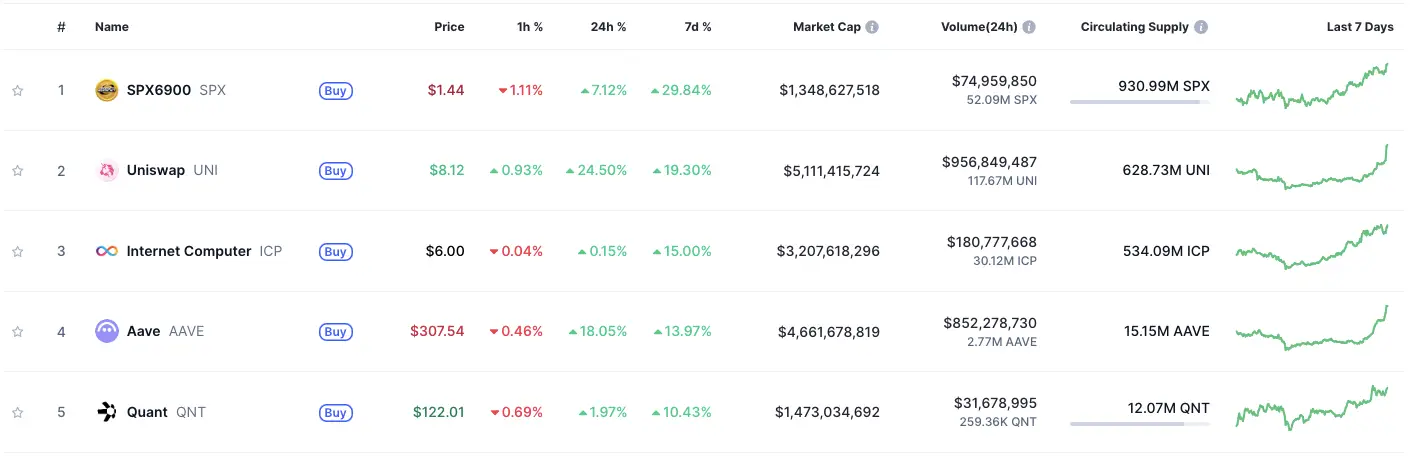

Aave, university and ICP are top winners at Kryptos over $ 1 billion capitalization

- Aave, university and ICP lead the weekly growth of the crypto projects with more than one billion dollar market capitalization.

- More and more investors are moving from memoins to cryptocurrencies with measurable benefits in the defi and infrastructure sector.

Three large old coins, AAVE (AAVE), Uniswap (university) and Internet Computer (ICP), were among the five largest weekly winners in the Altcoin market segment with market capitalization of over one billion dollars. The recent seven-day data show that these assets recorded a strong increase in price, while most digital assets with great market capitalization remained relatively stable. In the middle of broader signs of capital rotation in defi and infrastructure-related protocols, the increases take place in the middle of the crypto ecosystem.

Uniswap led the group with an increase von 19,30 % Last week and reached a trading price of $ 8.12. The decentralized Exchange token rose within 24 hours a 24.50 % And thus recorded one of the strongest day growth among the top animal assets. With a market capitalization of $ 5.1 billion and a daily trading volume of almost $ 957 million, Uni showed signs of a continuing market interest.

The increase is due to the increasing activity within the Defi protocols and the Uniswap Dao governance updates. Although no individual catalyst could be identified, the increasing participation of the voters and the interest in protocol upgrades could contribute to this.

Aave shows strength

Aave also recorded a weekly increase of 13.97 %, with a jump of 18.05 % in the last 24 hours. The token of the Lending Protocol is traded at $ 307.54 and has a market capitalization of $ 4.66 billion. In addition, his 24-hour trade volume exceeded $ 852 million, which makes it one of the most active defi tokens this week.

The growth show a growing appetite for defi credit services. In addition, the on-chain metrics indicate an increase in borrowing and lending activities, while the developers continue to research risk-adapted credit models.

Internet computer lists steady slow climb

Internet computer (ICP) laid in the week A 15.00 % to and noted at 6,00 $. While the 24-hour change was a modest 0.15 %, the seven-day chart of ICP shows a stable upward trend. The market capitalization of the token is $ 3.2 billion, with the daily volume reaching around $ 180 million.

The growth of ICP is related to the developments in his ecosystem and the increased commitment of the developers in his Web3 infrastructure. The protocol focuses on decentralized internet and application hosting, and the latest upgrades have drawn attention to its long-term potential. Although the asset only recorded limited movements at short notice, his weekly course indicates a growing interest among builders and investors.

Other winners are followed by the leader of the week

In addition to AAVE, university and ICP, two other tokens, SPX6900 and Quant (QNT), the top five list of weekly winners among the crypto-assets with a market capitalization of over $ 1 billion. While SPX6900 remains a relatively new market participant with limited historical data, the profits of quant seem to be driven by corporate-oriented blockchain integrations and token utility narratives.

The performance of these five tokens reflects a broader shift in the market focus. Instead of high volatility or meme-driven assets, investors are turning to defined applications, especially in the areas of lending, decentralized stock exchanges and infrastructure.

No Comments