A fidelity manager is convinced: Bitcoin replaces gold as the safest system

- Bitcoin’s strong rally in 2024 and a changed risk mood make BTC a new safe-haven-asset.

- The market metrics indicate uncertainty because the whales move their positions near $ 95k, which indicates a possible turning point.

Jurrien Timmer, Director of Global Macro at Fidelity Investments, Wies on An important shift in performance metrics and noticed the changed role of Bitcoin in the global markets.

Ironically, gold and bitcoin are negatively correlated to each other. As the chart below shows, both assets have been taking turns lately, as measured by their Sharpe Ratios. From the looks of it, it may well be bitcoin’s turn to take the lead, given that its Sharpe Ratio is… pic.twitter.com/yhTDRemt3e

– Jurrien Timmer (@TimmerFidelity) May 2, 2025

He said that the Sharpe Ratio from Bitcoin is -0.4, while gold is significantly higher at 1.33. The negative correlation between the two assets is the reason for the discussions about the “wax release”.

Bitcoin also attracted all attention in 2024 after finally the last month Long expected $ 100,000 mark has, according to Timmer. Gold still had a solid year and was before the S&P 500.

But even during the increase, gold in the past ten years suffered from increasing volatility, while its price increase was put in the shade through the attraction of Bitcoin in the broad society and its parabolic price.

Bitcoin is currently being traded at $ 96,505.39. This is only a little less than the last high, and experts disagree whether the current level is the sign of a long -term consolidation phase or whether there is another rally.

Bitcoin “trading whales” withdraw

Although the Bitcoin course risen is, some indicators show that large retailers begin to take a more careful posture. The area between $ 92k and $ 95k, as he was in the Dilated by FundingVest Data is shown has become crucial.

The entire long positions in this area have decreased, which indicates that some dealers are more likely pour out as increasing. The second aspect can be From the relationship between long andShort position discountsthe is clearly on the short side.

Top -class traders have got out of their positions or are waiting on the sidelines. The ratio of positions to accounts that measures the risk of risk has decreased from previous highs. Once again, investors take part of their profits, while others sell the market empty to protect themselves from slipping.

If the net long positions continue to drop and the short positions increase, this could put the market under pressure and make prices go back. However, if too many dealers plunge into short positions, a squeeze could quickly raise the prices.

The mood at whales indicates increasing number of short positions

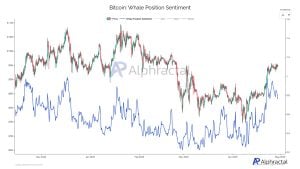

Another important indicator of the market is the activity of the whales. Of the Alphractal created whale position sentiment indicator shows some signals that indicate that the most influential whales in cryptocurrency tend to short positions .

This measurement, the Transactions of at least $ 1 million on the premium platforms and compares them with the range of contracts, shows a historical correlation of 93 % with the Bitcoin price. The bear’s bearing mood of the whales has often been a good sign that prices will soon drop.

At that moment the metric decreases while the Bitcoin price increases, was the conclusion allows that There are now big dealers who Take short positions.

Should This situation would last long, this would be the end of the recent upward trend of Bitcoin and the beginning of a short -term drop in prices. On the other hand, when the mood turns and the whales go back to long positions, an increase to $ 100,000 and even more is possible.

No Comments