5.7 billion XRP deducted from stock exchanges – should artificial shortage push the course?

- Binance and Upbit recorded a decline in XRP reserves by $ 12.4 billion, which indicates long-term investors.

- 5,736 billion XRP was withdrawn from the stock exchange trading in just one week, almost 10% of all tokens – an offer shock can be the result.

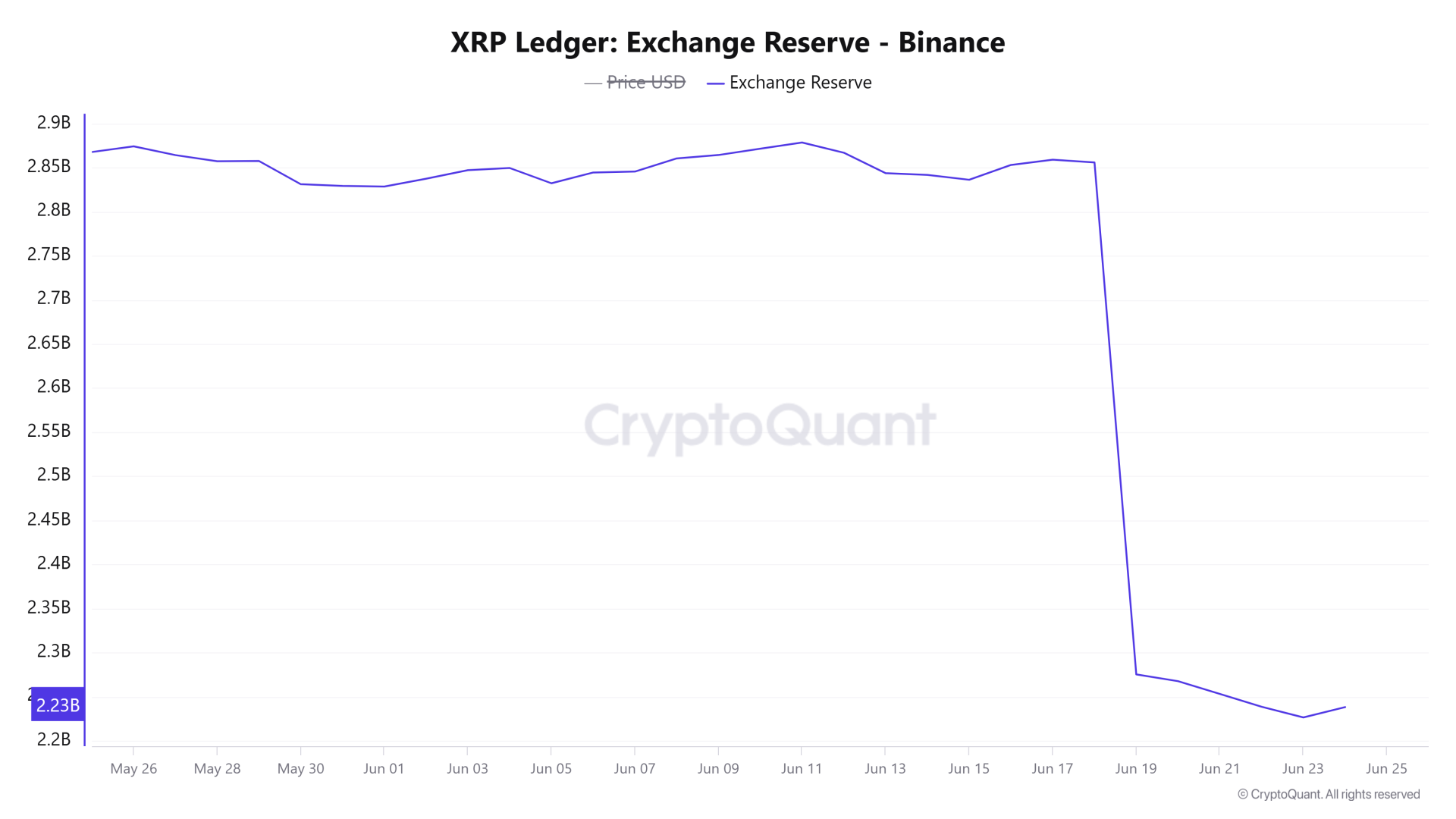

A severe decline in XRP reserves for several leading crypto exchanges, including Binance and Upbit, caused a sensation. The development, which was followed by the cryptoquant analysis, triggered speculation through an offer shock.

While the XRP course continues to be around the twice dollar, the action indicates an increasing departure of the investors from centralized stock exchanges. In the midst of this market behavior, speculation over an outbreak is increasing, even if the uncertainty continues.

Binance and upbit lose most of the reserves

The cryptoquant data show that a total of 5.736 billion XRP tokens have been deducted from the large stock exchanges since June 18. With a current market value of $ 2.17 per token, this corresponds to a value of $ 12.45 billion in XRP-almost 10 % of the circulating offer of 58.9 billion. The biggest drains were observed at the South Korean exchanges upbit and binance.

The reserve von upbit fell from 6.069 billion XRP to 1.08 billion within a week. This decline of 4.989 billion tokens is the most important among all centralized platforms.

As reported by CNF, Binance followed with a decline of 617 million XRP and reduced its reserves from 2.855 billion to 2.238 billion tokens. Bybit and Bitfinex recorded smaller declines of 127 million XRP or 3.15 million XRP.

Market analysts, including Mr. Xoom, saw in these movements an indication of the withdrawal behavior of the investors. Remi Relief, another known market commentator, speculated that the withdrawals could trigger an offer shock that could drive the XRP price into an area between $ 25 and $ 75 if the demand escalates.

Reasons for the withdrawals unclear

The decline is clear, but the reason is unknown. Large drains like this generally mean that investors now ducked their assets, i.e. keep in the long term and do not exert direct sales pressure. This is a positive sign for most market participants. However, experts also consider other explanations possible. Cold wallet transfers or internal rebalancing operations could also be the cause.

It is noteworthy that no large onchain transactions were displayed by the affected stock exchanges of Whale Alert or discovered by XRP scan. This raises the question of whether the massive decline, especially with the 4.98 billion XRP from Upbit, is a registration error or an operational shift.

Despite the scope of the withdrawals, the XRP course has not shown any reaction. He still fluctuates around the two dollars, a range in which he has been located since February. Market observers say that a decline in reserves is not synonymous with direct purchases, so that the effects are rarely immediately recognizable.

While the situation unfolds, the mood of the investors is shared. Some see the decline in currency reserves as harbinger of a house, others are waiting for other signs before they judge. Until the reason for these massive drains is confirmed, the short-term XRP course direction is unknown.

No Comments