400 million dollar cyber attack on Coinbase-what was (and what not) cracked?

- Hacker Coinbase insider to steal customer data; No passwords were compromised; Coinbase rejected a ransom of $ 20 million.

- Coinbase is faced with costs of up to $ 400 million, opens up a US support center and exposes a reward of $ 20 million for the attack of the attackers.

Coinbase has uncovered a cyber attack in which brilliant support employees from abroad stole customer data. Violation affected Only a small group of users can cost the company up to $ 400 million.

The hackers demanded a ransom of $ 20 million that Coinbase did not want to pay. The company works with the law enforcement authorities and has set up a reward fund to take those responsible.

How the burglary came about and which data was accessed

According to Coinbase Hackers have bribed several contractors and employees who worked abroad as customer supervisors. These insiders used their access to customer support systems to steal data. The stolen data included names, addresses, telephone numbers, emails, images of authorities and partially social security and bank details. However, no passwords, private keys or 2FA codes were disclosed.

Cyber criminals bribed and recruited rogue overseas support agents to pull personal data on <1% of Coinbase MTUs. No passwords, private keys, or funds were exposed. Prime accounts are untouched. We will reimburse impacted customers. More here: https://t.co/SidVn59JCV

— Coinbase

(@coinbase) May 15, 2025

Less than 1 % of Coinbase users were affected, around 84,000 customers. The attackers used this data for social engineering attacks, in which they expose themselves as coinbase employees to move the victims to transfer funds. Coinbase will compensate customers who have transferred money to the attackers after they have been deceived.

The company learned from the security violation months ago, dismissed the employees concerned and increased the surveillance. The attackers requested a ransom of $ 20 million so that the data is not published. Coinbase rejected the payment and instead set up a $ 20 million reward fund to help with the attack of the attackers.

Coinbase and the effects on the industry

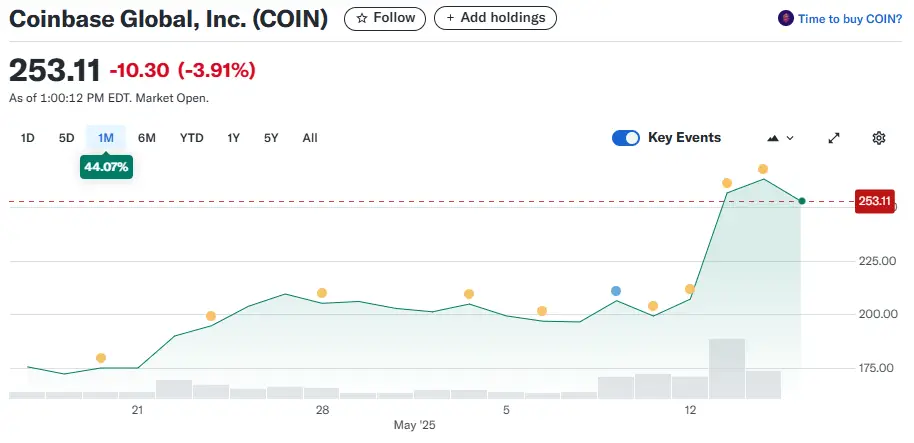

The coin base share fell by 3 %after the announcement. The company estimates the loss of $ 180 to $ 400 million. Despite the loss, Coinbase is everything about customer protection and transparency.

Coinbase is about to be taken up in the S&P 500, which is of great importance for the crypto industry. This will probably cause the industry to tighten the employee review and internal security. Bo Pei, an analyst at US Tiger Securities, said that this will cause the industry to introduce stricter access controls for employees.

The crypto industry is still plagued by security problems while developing into a mainstream. At the beginning of this year, a hack became known at Bybit, in which digital tokens worth $ 1.5 billion were stolen-one of the largest crypto robberies. A report by Chainalysis shows that crypto platforms lost $ 2.2 billion through hacker attacks in 2024.

Nick Jones, founder of the crypto company Zumo, said that the rapidly growing crypto industry attracts increasingly sophisticated attackers. This is a reminder to take care of insider threats.

The reaction of Coinbase and measures to improve security

Coinbase will compensate customers who have been cheated by social engineering attacks. You will also be released all employees who were involved in the data leak.

CEO Brian Armstrong showed the ransom claim of the attackers publicly back. Instead, Coinbase has launched a $ 20 million reward program to create incentives for information that leads to the arrest and conviction of those responsible. Coinbase will open a new customer support center in the USA to reduce the dependency on support in overseas and the internal supervision.

Chief Security Officer Philip Martin said it was a difficult situation, but Coinbase was transparent and improves. He said that they take responsibility for their mistakes and improve fraud recognition and transaction monitoring.

These are efforts to restore trust and prevent future violations. Coinbase is the largest crypto exchange in the United States and expands worldwide, including a recent takeover and entry into the S&P 500. In an earlier article we reported that The company has completed the takeover from Deribit for $ 2.9 billion. This was the largest crypto fusion and acquisition so far, which further consolidated Cooinbase’s position on the market.

Coinbase is the first crypto company to be included in the S&P 500 Index with effect from May 19. Coinbase is traded under the ticker symbol ‘Coin’. Last month, the coin share increased by more than 17 % to around $ 224. However, the performance for the current year is still negative with a minus of more than 16 %, which reflects the mixed mood of investors despite the latest price gains.

No Comments