- 21Shares expands its offering on Nasdaq Stockholm to 16 ETPs six new single asset and index products.

- The company is also launching a leveraged Dogecoin ETF on Nasdaq.

21Shares hat six new crypto products on Nasdaq Stockholm introduced and set about expanding access to regulated products for Scandinavian investors. Currently has 21Shares 16 ETPs an der Nasdaq in Stockholm.

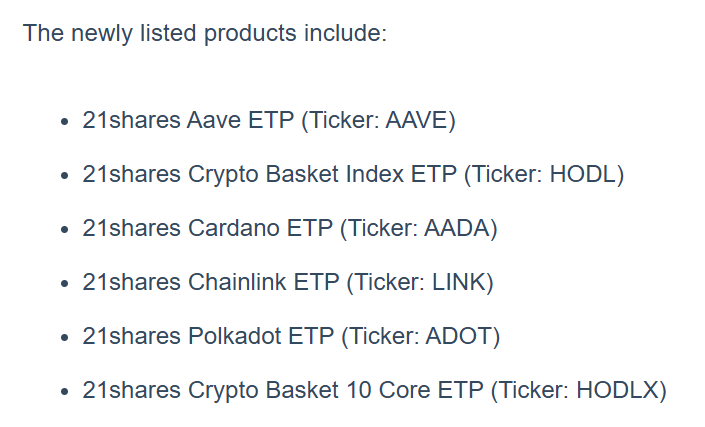

The list of new additions includes Aave, Cardano, Chainlink, Polkadot and two multi-asset baskets that expand the already existing projects Bitcoin, Ethereum Staking, Solana and Bitcoin Core.

More offers in the Scandinavian market

The new products AAVE, AADA, LINK, ADOT, HODL and HODLX expand the range of single-asset and index-based products on the regulated trading venue in Stockholm.

All ETPs are complete secured and physically backed, so that investor engagement is directly linked to the underlying assets, unlike synthetic structures.

The update strengthens the presence of the Company in the region where regulated trading venues for private and institutional investor are attractivewhich provide access to diversified and cost-effective want to have crypto markets.

This is happening after continued increase in Nordic exposure to large-volume crypto assets. The transparent pricing, the simplicity of processing above traditional brokers and that Miss of wallet handling requirements it Market interests helped .

21Shares is expanding into the multi-exchange market

The growth is in line with the larger multi-exchange presence from 21Shareswhich already at the SIX Swiss Exchange, Euronext Paris, Euronext Amsterdam, Deutsche Stock market Xetra and the London Stock Exchange consists.

The company currently manages worldwide assets of around 8 Mrd. USD in ETPs for large caps, staking exposure and index approaches.

Meanwhile hat 21Shares just last Thursday a 2x Long Dogecoin ETF with the Ticker TXXD on Nasdaq introduced.

With this addition, leveraged products are part of the growing European offering of the companywhich keeps 21Shares on the rise in both sector-focused and highly volatile crypto markets.

No Comments