What occurs when you die with no will as Liam Payne’s last fortune is revealed

Following his dying final yr, it has been revealed that Liam Payne didn’t have a will, abandoning a £24 million fortune.

Payne, 31, had been in Buenos Aires, Argentina, when he fell from a resort balcony in October, with the postmortem stories revealing that the singer had died of a number of traumas in addition to ‘inner and exterior haemorrhage’ sustained by the autumn.

Payne’s funeral was held in Amersham, UK, in November, along with his One Route bandmates, Harry Kinds, Zayn Malik, Niall Horan and Louis Tomlinson, ex-girlfriend Cheryl and their eight-year-old son, Bear, had been all in attendance.

Yesterday, it was revealed that the singer had not issued a will earlier than his dying, so the way forward for his cash and property had been left within the arms of the court docket.

In accordance with court docket paperwork, Payne’s last determine of £24,280,000 can be handed to ex Cheryl and music lawyer, Richard Bray, with each being granted energy of administration.

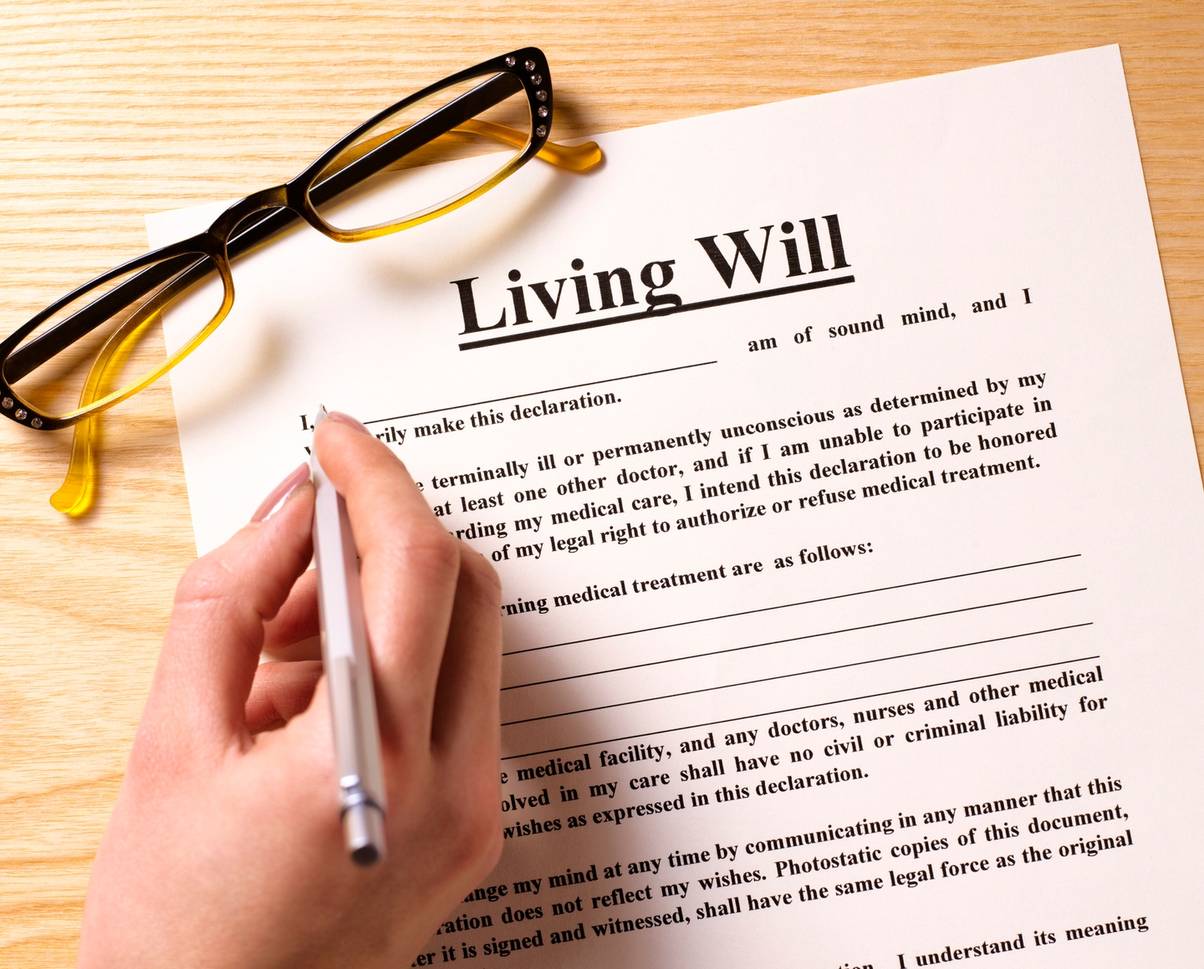

Who inherits if somebody dies with out making a will?

The overall rule for somebody’s cash and property is for it to go to the individual’s partner or civil companion, nonetheless, Payne was not married on the time of his dying – this implies his girlfriend, Kate Cassidy, will even not inherit something.

Liam and Cheryl had been additionally by no means married and solely dated between 2016 and 2018.

Unsurprisingly, guidelines are already in place in situations corresponding to this, with the ‘guidelines of intestacy’ figuring out Payne as an ‘intestate individual’.

In accordance to Citizen’s Recommendation, if the property worth is increased than £322,000, then it might be shared between a partner and any youngsters.

Cheryl is the mom to Payne’s son, Bear, and when the ‘administration interval’ proceeds, she and Bray can be chargeable for distributing the cash, so it’s anticipated that some will go right into a belief fund for Bear, which he’ll then be capable of take management of and entry himself when he comes of age.

Within the case the place you allow behind a fortune of lower than £322,000, nonetheless, the youngsters of the deceased would not inherit something if there was a residing companion.

After all, that might later be divided between themselves, however different legal guidelines and taxes would additionally then come into play.

What in case you have no residing kinfolk?

Effectively, on this case, issues turn into much more hectic as a result of, as per the foundations of intestacy, the property would then move to the Crown – this course of known as ‘bona vacantia’.

From then on, the Treasury is in cost, and the Crown also can make grants out of your property, however they do not need to conform to them.

In different situations

Different guidelines also can apply, whether or not it involves rejecting inheritance, altering who will get what and the way grandchildren can profit, however most of them depend on household largely agreeing on every part – not like any type of Knives Out state of affairs.

Within the case you can’t inherit however really feel such as you’ve bought good grounds to, then the identical rule applies.

Nevertheless, if the dying has left you in a worse place, then it may very well be taken to court docket, wherein case it will can be their resolution whether or not you might be entitled to inherit something.

No Comments